Arm CEO says AI software sell-off is ‘micro-hysteria’

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Arm boss Rene Haas has said fears about AI hurting software companies, which triggered a market sell-off this week, are a “micro-hysteria” that exceeds the reality of how businesses are using the tools.

The chief executive of the SoftBank-owned chipmaker played down anxiety about the software group being disrupted by AI coding and workplace tools, such as the one recently released by Anthropic that kicked off a market rout.

“As I look at enterprise AI deployment, we aren’t anywhere close to where it can be,” Haas said. Coding was “not the monster use case across world GDP . . . I think people are maybe kind of confusing a whole bunch of different things here,” he added.

The Arm CEO last month played down the impact of AI on the global economy, saying it was only in its early stages of deployment, especially in the enterprise space.

His comments on Wednesday came as the UK chipmaker announced earnings that sent its stock down 8 per cent after market.

The group issued an outlook for the fourth quarter that was only slightly ahead of analysts’ forecasts, which disappointed investors looking for strong growth from tech companies. Chip companies, including AMD and Qualcomm, have also suffered from investors’ nerves around a shortage of memory chips limiting consumer electronics sales.

Arm reported net income of $223mn on revenue of $1.2bn in its third quarter, roughly in line with Wall Street estimates.

It also forecast a long-term windfall from central processing unit chip sales that Haas said were experiencing a boom in demand.

Arm was on track to generate more revenue from its data centre business than from smartphones within a “couple of years”, Haas said on Wednesday, in what would represent a profound shift for a company that is primarily known as the dominant technology used in the smartphone sector.

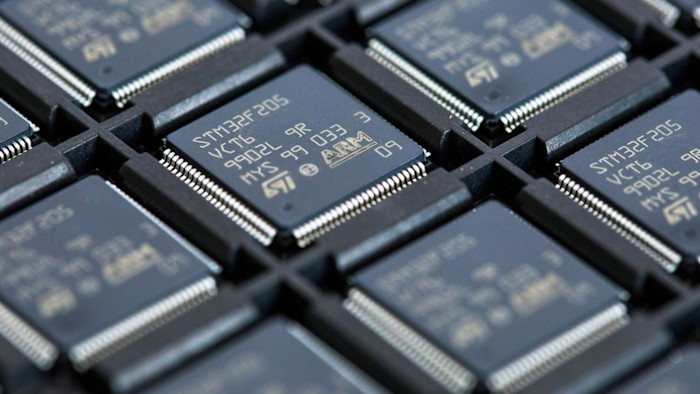

Arm specialises in CPU designs that are incorporated by chip giants, such as Nvidia, into their own data centre products alongside advanced graphics-processing units, which carry out the massive computations needed to train AI models.

Haas said Arm held about a 50 per cent share of this data centre market, where it competes with the rival X86 technology of Intel and AMD.

Thanks to the AI boom, data centre chips were on course to be “our largest business” in part because the company was able to charge higher royalty rates for newer generations of its chip designs, Haas said.

Arm generates revenue from licensing its chip blueprints to other companies as well as taking a cut on final sales. Royalties from data centre chip sales were up 100 per cent year on year, Haas said.

Haas highlighted booming demand for CPUs as a crucial future driver of growth, as tech giants such as Nvidia, Amazon and Microsoft considered them increasingly critical to running AI agents — a process known as “inference”.

Analysts have increasingly questioned whether GPUs, which dominated the initial wave of investment in AI infrastructure to train the most powerful models, will start to be displaced by more specialised chips aimed at inference workloads.

First Appeared on

Source link