Piper Sandler Eyes 2 Dividend Stocks Offering Yields as High as 13%

The bull market took a bit of a breather last week, with Wall Street growing uneasy following troubles in the U.S. regional banking sector. Though markets did close the week in the black after a Friday recovery, Thursday was a bit of a downer as two regional banks revealed issues with bad and fraudulent loans. This sparked concerns about a deeper malaise within the system.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Might now be the time to consider some defensive plays?

That mindset will naturally lead us down the path to dividend stocks – the classic defensive move. These names tend to be more stable and less volatile than riskier asset classes. Moreover, top-quality dividend stocks boast consistent payouts and attractive yields, offering investors a source of steady income.

Piper Sandler analyst Crispin Love has been eyeing the segment and has spotted an opportunity in two dividend stocks that just might fit the bill.

Even better, running both tickers through the TipRanks database, we find both are viewed positively by Wall Street analysts. Let’s dig in.

Annaly Capital (NLY)

Those seeking dividend stocks with high yields will often turn to REITs (real estate investment trusts), which are known for their steady income streams and requirement to distribute most of their earnings to shareholders. This is the segment Annaly Capital operates in.

Annaly is a leading mortgage REIT and diversified capital manager based in New York. It mostly invests in mortgage-related assets – including agency mortgage-backed securities, non-agency residential loans, commercial mortgage securities, mortgage servicing rights, and other real estate credit instruments.

Although NLY operates across several segments, its agency MBS portfolio is the main breadwinner. As of the end of Q2, the company held a total portfolio valued at $89.5 billion, with $79.5 billion invested in its highly liquid Agency MBS strategy. This segment accounts for 89% of total assets and 62% of the firm’s allocated capital. Residential Credit accounted for $6.6 billion, while Mortgage Servicing Rights made up $3.3 billion.

Elsewhere in the quarter, the company generated an adj. EPS of $0.73, beating the Street’s forecast by $0.02, and enough to cover its $0.70 dividend. The last payment was declared on September 10 and will be paid out on October 31. NLY’s dividend offers a 13.6% yield, far above the sector average of 3.3%.

The robust dividend forms part of Crispin Love’s investment thesis here. The Piper Sandler analyst writes: “The environment has changed dramatically in recent months given the start of the Fed rate cutting cycle as well as significant agency spread tightening and GSE reform commentary. We expect the forward return outlook as well as the potential for GSE reform to be popular topics on the earnings call. We remain Overweight on Annaly given its diversified model that can perform in numerous environments, its solid dividend, and attractive valuation.”

That Overweight (i.e., Buy) rating is backed by a $22.50 price target, suggesting the stock will gain ~8% over the coming months. Add in the dividend, and investors could be pocketing returns of more than 20%. (To watch Love’s track record, click here)

Turning to the general Street view, NLY stock claims a Moderate Buy consensus rating, based on a mix of 5 Buys vs. 2 Holds. At $21.57, the average target factors in a one-year gain of ~4%. (See NLY stock forecast)

Rithm Capital (RITM)

We’ll stay in the same REIT neighborhood for our next dividend name. Rithm Capital is a U.S.-based real estate and financial services company that acts as both a REIT and an asset manager. The company’s activities cover mortgage origination and servicing, real estate investment, credit strategies, and alternative asset management.

Its main subsidiaries — Newrez, Genesis Capital, and Sculptor Capital Management — manage a mix of residential and commercial mortgage assets. Rithm’s approach aims to balance interest rate-sensitive mortgage assets with fee-based and alternative investments. Over time, the company has moved beyond being a mortgage-focused REIT, building a broader platform that combines cash flow from mortgages with income from asset management and other financial activities.

As of June 30, 2025, Rithm Capital’s total portfolio included roughly $80 billion in investable assets, with $44 billion on its balance sheet and $36 billion in assets under management (AUM) through Sculptor Capital Management.

In Q2, Rithm’s EAD (earnings available for distribution) came in at $0.54 per share, representing 15% year-over-year growth, and beating the Street’s call by $0.02.

That easily covered the dividend. Rithm’s most recent dividend was declared on September 17, slated for a payout on October 31. The current quarterly dividend stands at $0.25 and offers a 9.3% yield.

When we turn to the Piper Sandler take here, we find that analyst Love takes an optimistic view of Rithm’s prospects. “We expect Rithm to generate an EPS quarterly run rate of $0.50+ throughout 2025 & 2026 with potential upside depending on rates,” he says. “This is well above the current $0.25 dividend run rate. We recently made Rithm our fourth quarter favorite given its ability to benefit from the rally in mortgage rates and a valuation that we believe is too cheap to ignore given certain actions that company could take in coming quarters as it scales its asset manager business and the broader platform.”

Love rates RITM as Overweight (Buy), while his $15 price target points toward one-year gains of 38.5%. Factor in the dividend, and those returns could reach the high 40%s.

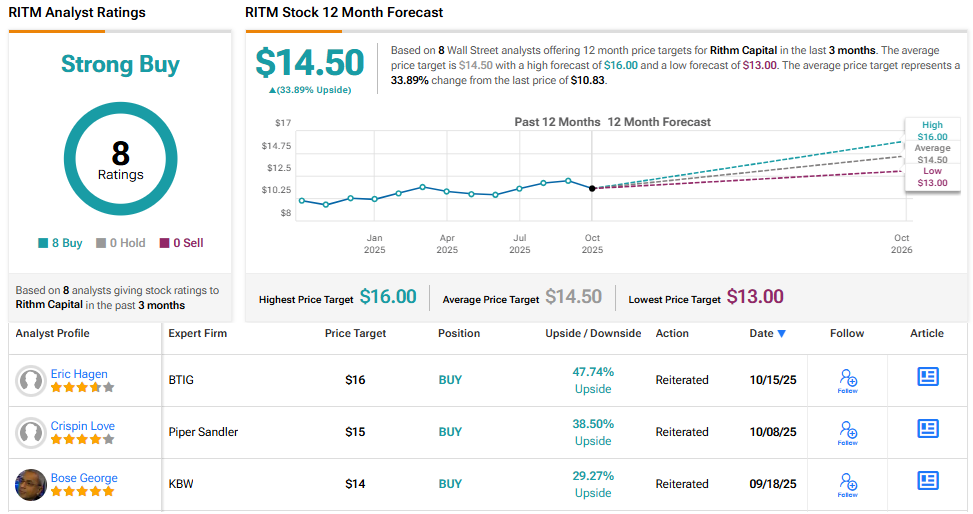

All of Love’s peers agree with his bullish stance. Based on 8 Buys, the stock naturally claims a Strong Buy consensus rating. Going by the $14.50 average target, shares will be changing hands for a ~34% premium a year from now. (See RITM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

First Appeared on

Source link