Is American Airlines (AAL) a Good Stock to Buy before Earnings?

Airline company American Airlines (AAL) is set to report its Q3 earnings results on October 23 before the market opens. Analysts are expecting earnings per share to come in at -$0.28 on revenue of $13.63 billion. This compares to last year’s figures of $0.30 and $13.65 billion, respectively. These year-over-year declines are being forecast due to softer unit revenue trends across domestic and international markets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, in the previous quarter, AAL posted an adjusted EPS of $0.95, which had beaten estimates. At the same time, it achieved record revenue of $14.39 billion. Still, despite that strong quarter, the company pointed to softer demand, flat pricing, and rising costs as key headwinds heading into Q3. Nevertheless, AAL has a strong track record when it comes to beating earnings, missing only twice in the past 16 quarters.

Besides EPS figures, investors should keep an eye on other metrics, such as passenger enplanements, which counts the number of passengers boarding flights. This is a key measure because it provides investors with some insight into demand and whether or not the company is growing its market share. Notably, AAL has seen this figure trend upwards in the post-pandemic era, as pictured below.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a 6.4% move in either direction.

What Is the Price Target for AAL?

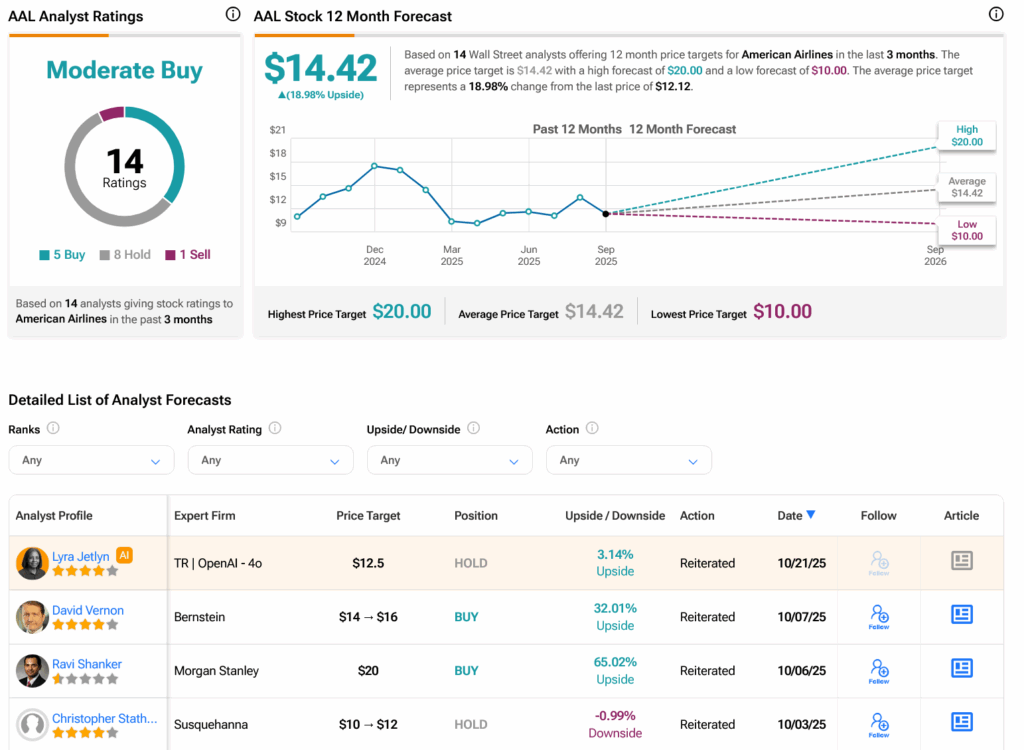

Overall, analysts have a Moderate Buy consensus rating on AAL stock based on five Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAL price target of $14.42 per share implies 19% upside potential. At the same time, TipRanks’ AI analyst has a Neutral rating and a $12.50 per share price target.

First Appeared on

Source link