Should You Buy XRP (Ripple) While It’s Under $3?

Here’s why this popular cryptocurrency might be due for a reality check.

It’s really difficult to find a reasonable market value for XRP (XRP +0.85%). Simple web searches such as “XRP fair value” will give you pages and pages of outlandish price targets.

Some speculators assume that XRP will dominate international payments very quickly and almost completely. Others seem to confuse XRP’s transaction volume with free cash flows and other profit metrics, offering “discounted cash flow” calculations based on unreasonable input values.

Either way, the price targets often land at thousands (or tens of thousands) of dollars. The mildest one of these ultra-bullish calculations would unlock XRP returns of many thousand percent, presumably very quickly.

If something sounds too good to be true, it usually is. In fact, I’m quite convinced that XRP is a bit overvalued at $2.50 per coin, and due for a price correction fairly soon.

Here’s why I’d rather sell XRP than buy it at the current price level.

Today’s Change

(0.85%) $0.02

Current Price

$2.64

Key Data Points

Market Cap

$159B

Day’s Range

$2.60 – $2.67

52wk Range

$0.49 – $3.65

Volume

3.8B

Avg Vol

0

Gross Margin

0.00%

Dividend Yield

N/A

The “Trump bump” sent XRP soaring

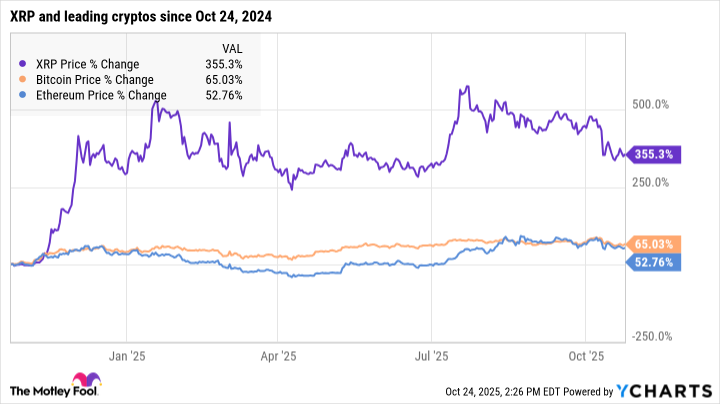

On Oct. 24, 2025, XRP has gained 355% in 52 weeks. Last year’s election results sent this cryptocurrency soaring, as the long-running Securities and Exchange Commission (SEC) lawsuit surely would end under a more crypto-friendly administration. With that dark cloud out of the way, XRP was projected to soar, as the integrated RippleNet international payment network got the green light to operate in America.

Sure, other cryptocurrencies also rose on the election results — but big names like Bitcoin (BTC +3.46%) and Ethereum (ETH +7.24%) could not keep up with XRP.

Not all the promised changes have arrived

The lawsuit has indeed been dismissed, but the Trump administration has yet to present a legal and regulatory framework for cryptocurrencies. The Genius Act added some clarity for stablecoins, but the broader Clarity Act is stalled by the ongoing government shutdown. If and when it’s signed, the Clarity Act would clear up the roles of the SEC and the Commodity Futures Trading Commission (CFTC) in setting and enforcing rules for trading Bitcoin, XRP, and other cryptocurrencies.

Furthermore, XRP was not included in the hotly anticipated Strategic Bitcoin Reserve. Some of last November’s price surge was based on assuming that inclusion, which would have made the U.S. government an active buyer of XRP.

I get the excitement, since a proper XRP reserve could result in XRP being used for big-ticket government transactions. But that’s not what happened, and it’s time to let go of this XRP-boosting expectation.

Let’s get real about XRP’s potential

I do believe that XRP has a bright future. RippleNet looks ready to shoulder a larger portion of the border-crossing payments market, which amounted to $195 trillion in 2024.

But you have to set reasonable expectations for this growth story.

-

Even if XRP ends up managing the entire global money transfer market, there’s a big difference between value transfers and RippleNet profits. The coin is known for its very low transaction fees — fractions of a penny, even for very large transactions.

-

Just a small slice of the global payments market could make XRP a major player. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) service is adopting digital payment technology. Other options include credit cards, digital wallets, Wise (OTC: WPLC.F), and PayPal (PYPL +0.00%). As you can see, the market is already fragmented, and XRP probably won’t change that.

-

The Ripple organization, which manages XRP and the RippleNet service, is a private company with confidential finances. Until that changes, it’s impossible to say exactly how successful the payment service is, or how much money it makes. This uncertainty alone should result in lower XRP prices, since serious investors crave financial information.

So I would be an XRP buyer again — if the coin gave back most of last November’s gains. At $2.50 per coin, I’m tempted to sell the coins I own. This is definitely not a great time to double down on XRP.

Anders Bylund has positions in Bitcoin, Ethereum, and XRP. The Motley Fool has positions in and recommends Bitcoin, Ethereum, PayPal, Wise Plc, and XRP. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short December 2025 $75 calls on PayPal. The Motley Fool has a disclosure policy.

First Appeared on

Source link