BBAI vs. PLTR vs. NVDA: Which AI Stock Is the Best Pick, According to Analysts?

Massive spending commitments by many hyperscalers and other companies and multiple deals announced recently by tech giants like Nvidia (NVDA) and Advanced Micro Devices (AMD) continue to sustain investors’ focus on artificial intelligence (AI) stocks. However, not all companies are able to capture AI-led demand to the same extent and justify their valuations, raising concerns about an AI bubble. Given this backdrop, we used TipRanks’ Stock Comparison Tool to place BigBear.ai Holdings (BBAI), Palantir Technologies (PLTR), and Nvidia against each other to find the best AI stock, according to Wall Street.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BigBear.ai Holdings (NYSE:BBAI) Stock

BigBear.ai offers AI-powered decision intelligence solutions and services for national security, defense, and commercial customers. BBAI stock has rallied more than 62% year-to-date, driven by optimism about the demand for the company’s offerings amid the ongoing AI wave, especially in the government end market.

However, there are some concerns about BBAI stock’s valuation due to weakness in its fundamentals. BBAI reported an 18% decline in its Q2 revenue and a worse-than-anticipated loss, citing disruptions in federal contracts. Wall Street is currently divided on BBAI stock, with bulls optimistic about the company’s government contract wins, while other analysts remain concerned about weakness in its top line.

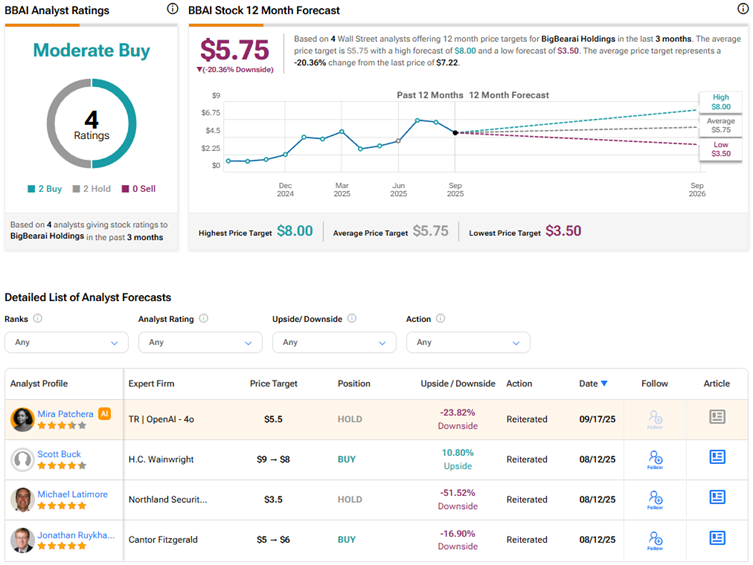

Is BBAI a Good Stock to Buy?

H.C. Wainwright analyst Scott Buck has a Buy rating on BigBear.ai stock and had slightly lowered his price target to $8 from $9 in August. Buck contended that while BBAI’s Q2 results were disappointing, they were not surprising, given that other players in the defense space also experienced program delays. The analyst expects better revenue visibility as the company heads into 2026.

In the longer term, Buck believes that BigBear.ai is well-positioned to benefit from the “One, Big, Beautiful Bill,” which involves growing investments in areas aligned with the company’s core competencies.

With two Buys and two Holds, Wall Street has a Moderate Buy consensus rating on BigBear.ai stock. The average BBAI stock price target of $5.75 indicates a downside risk of 20.4% from current levels.

Palantir Technologies (NASDAQ:PLTR) Stock

Shares of Palantir Technologies have jumped 132% year-to-date. The AI-powered data analytics company has proved itself by delivering impressive results for several quarters, driven by strength across its Government and Commercial businesses.

In fact, Q2 2025 marked the first time that the company’s quarterly revenue hit the $1 billion mark, with its Artificial Intelligence Platform (AIP) experiencing solid demand. While Palantir bulls are confident about the company’s ability to sustain solid momentum in its business, bears are concerned about the stock’s steep valuation.

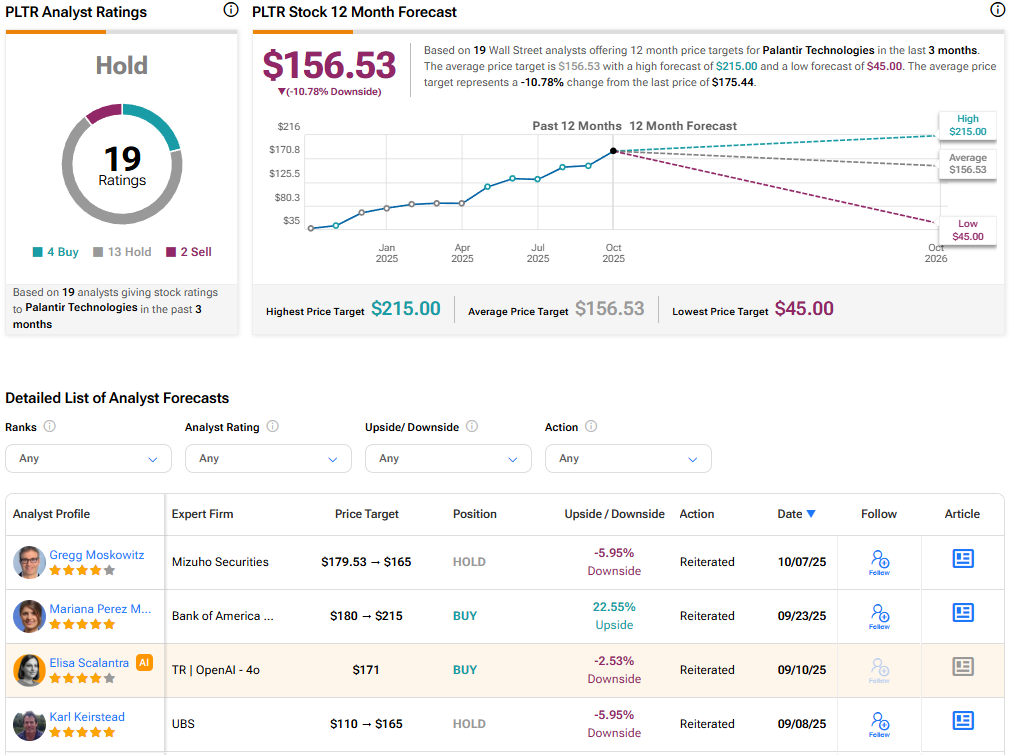

Is PLTR Stock a Buy, Hold, or Sell?

Recently, Mizuho analyst Gregg Moskowitz reiterated a Hold rating on Palantir Technologies stock with a price target of $165. After attending a demo at the company’s office about Palantir Ontology, the foundational layer of PLTR’s platforms, and other offerings that support mission-critical decision making, the 4-star analyst highlighted that the company’s recent execution has been impressive. Moreover, Moskowitz noted material upward revisions across both Commercial and Government businesses of Palantir.

While Moskowitz sees the possibility of PLTR shares being subjected to material multiple reversions over the next few quarters, he acknowledges that its uniqueness demands tremendous credit. The analyst believes that PLTR is increasingly well-positioned to benefit from long-term trends in AI, government digital transformation, and industrial modernization. That said, Moskowitz contends that PLTR stock’s valuation multiple remains “extreme, dramatically above anything else in software.”

Currently, Wall Street has a Hold consensus rating on Palantir Technologies stock based on 13 Holds, four Buys, and two Sell recommendations. At $156.53, the average PLTR stock price target indicates a possible downside of about 11%.

Nvidia (NASDAQ:NVDA) Stock

Semiconductor giant Nvidia is viewed as one of the major beneficiaries of the ongoing AI boom, thanks to robust demand for its advanced graphics processing units (GPUs). Despite concerns about growing competition from Advanced Micro Devices’ AI offerings and Broadcom’s (AVGO) custom AI chips, as well as the impact of escalating tariff wars between the U.S. and China, most analysts remain bullish on Nvidia stock.

Notably, Nvidia’s solid execution under the leadership of CEO Jensen Huang, continued innovation, and massive opportunities in sovereign AI are highlighted as key strengths by many analysts. Moreover, Wall Street is optimistic about Nvidia’s recently announced strategic deal with chipmaker Intel (INTC) and $100 billion investment in ChatGPT maker OpenAI (PC:OPAIQ).

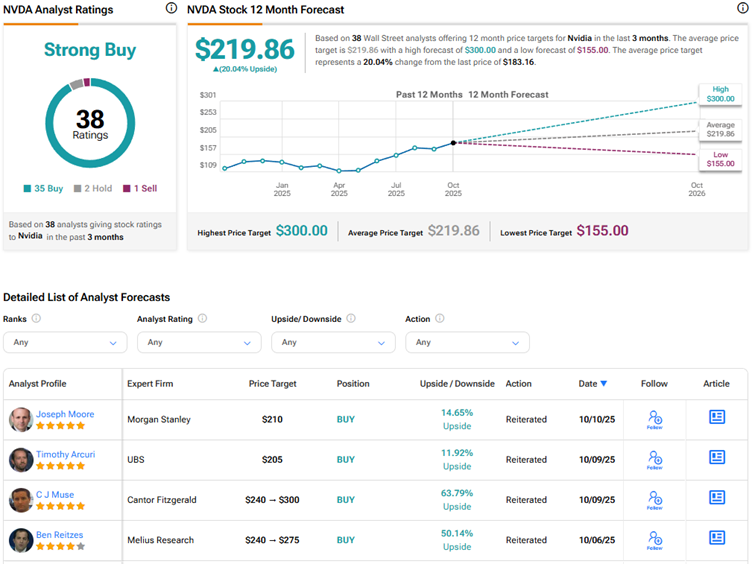

Is Nvidia a Good Stock to Buy?

Last week, Cantor Fitzgerald analyst C.J. Muse raised his price target for Nvidia stock to a street-high of $300 from $240 and reiterated a Buy rating, calling it a top pick in the AI hardware space. The 5-star analyst contends that we are not in an AI bubble but in fact in the early innings of a multi-trillion AI Infrastructure build-out, with just the hyperscalers providing significant line-of-sight into “hundreds of billions of demand for the next handful of years.” Muse expects other drivers such as neo-clouds, enterprise, and physical AI to offer additional upside.

The top-rated analyst views Nvidia’s partnership with OpenAI as a catalyst for the stock. Furthermore, Muse expects Nvidia to deliver earnings per share (EPS) of $8 in calendar year 2026 and $11 in 2027, well above the Street’s consensus estimates. In fact, he sees the possibility of the chipmaker’s EPS moving toward $50 by 2030 as global AI infrastructure spending ramps to the range of $3 trillion to $4 trillion.

Overall, Wall Street has a Strong Buy consensus rating on Nvidia stock based on 35 Buys, two Holds, and one Sell recommendation. The average NVDA stock price target of $219.86 indicates 20% upside potential from current levels. Nvidia stock has risen more than 36% year-to-date.

Conclusion

Wall Street is currently bullish on Nvidia stock and cautiously optimistic on BigBear.ai. Meanwhile, many analysts are sidelined on Palantir stock. Analysts see possible downside in BBAI and PLTR stocks due to valuation risks, while they expect further upside in NVDA stock. Wall Street expects Nvidia to benefit from strong demand for its GPUs amid massive AI spending, continued innovation, and solid execution.

First Appeared on

Source link