2026 FEHB and PSHB available plans and premium update

Last week, the Office of Personnel Management released 2026 Federal Employee Health Benefits and Postal Service Health Benefits plan information. After reviewing the updates, I want to share two key stories: the enrollee premium contribution increase and the lineup of available plans.

2026 FEHB premium increase

In 2026, federal employees and annuitants will face a 12.3% increase in the average enrollee premium contribution. While still significant, this marks a slight improvement from the 13.5% hike in 2025. According to OPM, key factors driving the increase include an aging federal workforce, a rise in chronic health conditions, and a growing demand for prescription medications, particularly GLP-1 drugs commonly used for weight loss.

Not all plans will be affected in the same way. For the 129 FEHB plans available in both 2025 and 2026, self-only premiums will decrease in 23 plans, increase below the average in 57 plans, and increase above the average in 49 plans.

Some of the self-only premium changes for 2026 are especially noteworthy. The largest decrease in enrollee share is 18% for Kaiser Permanente High (F81), available in Georgia, saving enrollees approximately $727 next year. On the other end of the spectrum, the largest percentage increase affects a small group: the Panama Canal Benefit Plan (431), which is limited to employees working in the Panama Canal Zone. That plan’s premium is rising by a staggering 139%, costing enrollees an additional $4,622. The next highest increase is 99% for UnitedHealthcare Choice Plus Primary (WF1), available in parts of Arizona, Nevada, Oregon and Washington, adding about $2,330 to the annual cost.

Available FEHB plans

Federal employees and annuitants will have 14 fewer plans to choose from next year. Most leaving the FEHB program are local, but one nationwide carrier, the National Association of Letter Carriers (NALC), is discontinuing their two FEHB plans, High Option and CDHP. However, NALC will still offer PSHB plans to Postal Service employees and annuitants.

You should receive notice from your carrier if your plan is terminated. Here’s the list of affected plans:

- NALC High (321, 322, 323) and CDHP (324, 325, 326)

- Aetna Open Access High (2U1, 2U2, 2U3, WQ1, WQ2, WQ3, YE1, YE2, YE3)

- Region: Georgia, Arizona, Pennsylvania

- AvMed HDHP (WZ1, WZ2, WZ3) and Standard (ML4, ML5, ML6)

- Blue Care Network of Michigan High (K51, K52, K53)

- Independent Health High (QA1, QA2, QA3)

- Priority Health High (LE1, LE2, LE3) and Standard (LE4, LE5, LE6) and Value (Y41, Y42, Y43)

- Sentara Health HDHP (PG4, PG5, PG6) and High (F21, F22, F23, PG1, PG2, PG3)

- Triple S Salud High (851, 852, 853)

If you’re currently enrolled in one of these plans, you’ll need to choose a new one this Open Season. If you do nothing, you’ll be auto-enrolled into the lowest cost nationwide PPO plan without membership fees: GEHA Elevate.

A few new plans will be available next year: Kaiser’s Prosper plan in their Fresno, California, market, and Baylor Scott and White’s Value plan in their Texas markets.

2026 PSHB premium increase

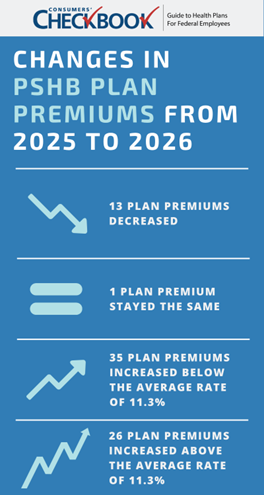

The enrollee premium contribution is also increasing for PSHB plans by an average of 11.3% next year, a smaller increase compared to FEHB. For the 75 plans in the PSHB program, self-only premiums will decrease in 13 plans, stay the same in 1 plan, increase below the average in 35 plans, and increase above the average in 26 plans.

Here are a couple of examples to illustrate the impact of these changes on self-only enrollees. UnitedHealthcare Choice Plus Primary East’s premium (JYA) is decreasing 30.37%, which will save enrollees $891. Medical Mutual of Ohio Standard (D3D) will cost 56.42% more, or an additional $4,175.

Available PSHB plans

USPS employees and annuitants will have two fewer plans to choose from next year. The following are leaving the PSHB program:

- GEHA Elevate (58D, 58E, 58F) and GEHA Elevate Plus (58A, 58B, 58C)

Impacted individuals will receive notice from their carrier, and you must select a new PSHB plan during Open Season. If you do nothing, you’ll be auto-enrolled into the lowest cost nationwide PPO plan without membership fees, which is BCBS FEP Blue Focus.

Key takeaways

2026 marks the second consecutive year of double-digit premium increases in the FEHB program, a trend that may continue. While most FEHB and PSHB plans are seeing higher premiums, the rate of increase varies widely, and a few plans are even decreasing in cost.

This Open Season, it’s more important than ever to review how your plan’s premium has changed and evaluate whether your current coverage still meets your needs. If your plan is exiting the FEHB or PSHB program, you’ll need to select a new one during Open Season. Otherwise, you’ll be auto-enrolled in a replacement plan that may not be the best fit.

I encourage you to send in your FEHB questions, and I look forward to answering them with actionable advice that might help save you money or better understand how FEHB works.

Kevin Moss is a senior editor with the Guide to Health Plans for Federal Employees provided by Consumers’ Checkbook. Watch more of his free advice and check here if the Guide is available for free from your agency. You can also purchase the Guide and save 20% with promo code FEDNEWS.

Copyright

© 2025 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

First Appeared on

Source link