US Sanctions on Russian Oil Giants Send Shockwaves Across China

(Bloomberg) — US sanctions on Russia’s energy giants are sending shockwaves deep into the heart of China’s oil industry, where both state and private refiners face heightened pressure to keep up supplies while steering clear of penalties.

As much as 20% of China’s crude imports — about 2 million barrels a day in the first nine months of this year — come from Russia, making it one of the country’s leading sources of oil for processing into products such as diesel, gasoline and plastics.

Most Read from Bloomberg

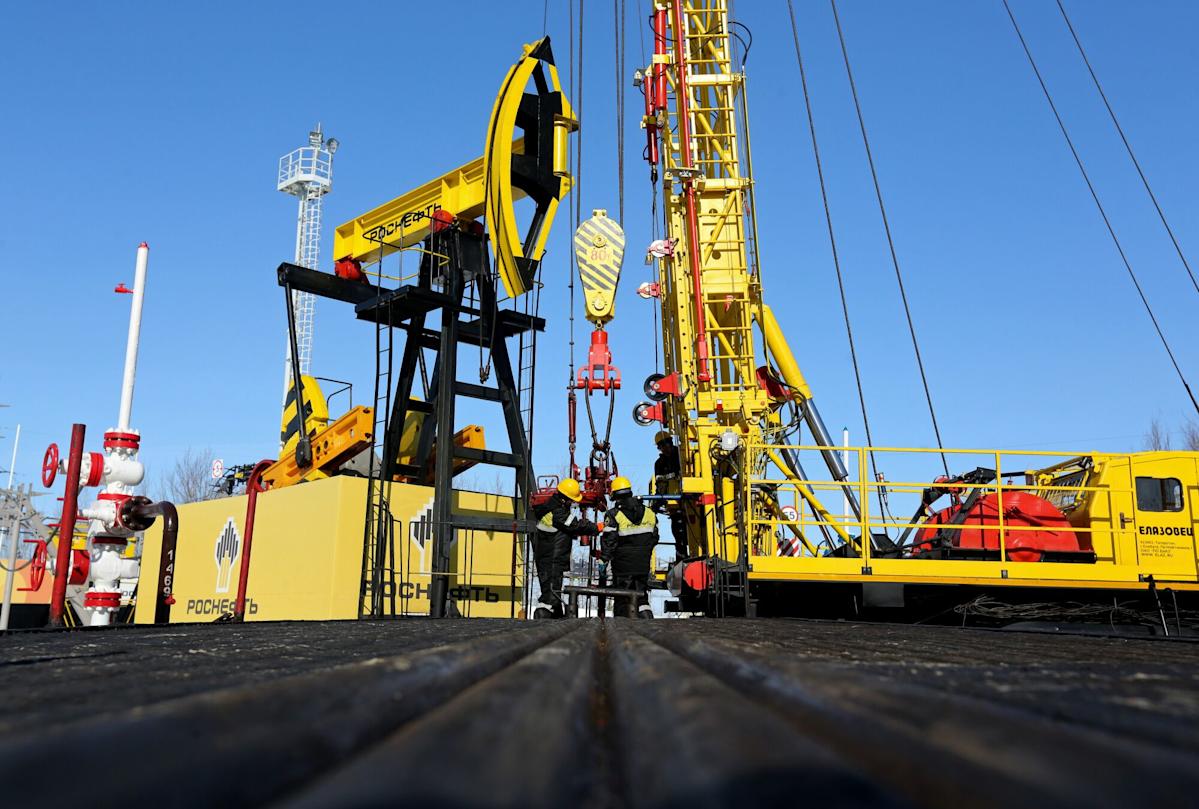

The Trump administration’s blacklisting of Rosneft PJSC and Lukoil PJSC is the latest in a series of measures rolled out by the US, the European Union and the UK targeting buyers of Russian crude, and the contribution they make to Moscow’s coffers and its war efforts in Ukraine. Transactions involving the two firms need to be wound down by Nov. 21, according to the US government.

The risk for China as well as India, Russia’s biggest customers, lies in their dealings with sanctioned entities, which can leave companies exposed to crippling secondary penalties. These include being cut off from western banking systems and access to dollars, or frozen out by the western producers, traders, shippers and insurers that form the backbone of global commodities markets.

Of particular concern is the role western firms play as investors and operators across major oil-producing regions such as the Middle East and Africa, traders say. Chinese and Indian companies that opt to continue working with sanctioned firms risk being sidelined or cut off from large numbers of projects.

If they choose to comply with the sanctions, they’ll lose access to deeply discounted supplies of oil that have helped keep energy costs low for industry and consumers. Additionally, buyers outside China and India are grappling with the impact on Lukoil, which is involved in Iraq’s Basrah project and the Caspian Pipeline Consortium in Central Asia.

The UK’s moves last week to blacklist Rosneft and Lukoil, as well as China’s Shandong Yulong Petrochemical Co. for its Russian imports, had already put traders on edge. Western companies have since become wary of supplying the privately-owned refiner. Other recent US sanctions have targeted major Chinese ports including Rizhao and Dongjiakou, key conduits for both Russian and Iranian oil.

Central to the mammoth trade between Russia and China is the long-term contract between Rosneft and state-owned China National Petroleum Corp., which involves purchases of ESPO crude via pipelines to landlocked refineries in the northern Daqing region. The plants there rely predominantly on Russian feedstock, according to traders, making them particularly vulnerable to any disruptions.

First Appeared on

Source link