Amazon Stock Sprints Ahead as Anthropic Doubles Investment in AWS’ AI

Amazon shares (AMZN) edged higher Wednesday after the company said Anthropic will double its investment in Amazon Web Services’ (AWS) AI infrastructure and begin scaling its models on Project Rainier, a new data-center cluster powered by nearly 500,000 Trainium 2 chips. The system, described by AWS as “the world’s most powerful computer” for training AI models, officially marks Amazon’s biggest leap yet into the AI hardware race.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Anthropic, one of the most closely watched AI startups and the creator of the Claude chatbot, is already training models on Project Rainier and is expected to be using over one million Trainium 2 chips by year-end, underscoring AWS’s central role in the next phase of generative AI infrastructure.

Project Rainier Comes Online and Boosts AWS’s AI Credentials

The launch of Project Rainier moves Amazon’s AI narrative from future plans to real-world execution. AWS now controls one of the largest active compute clusters ever built, positioning it to compete head-on with Microsoft’s (MSFT) Azure AI and Google (GOOGL) Cloud’s TPU infrastructure.

For investors, the completion of Rainier shows that Amazon’s AI strategy is starting to pay off. Instead of relying on third-party chips, the company’s in-house silicon offers customers more control, faster training speeds, and potentially lower costs. These benefits could translate into stickier client relationships and higher-margin cloud revenue as workloads shift toward AI-heavy training environments.

Anthropic Expands Its Commitment to AWS

Anthropic’s decision to double its spending on AWS infrastructure strengthens both sides of the partnership. It follows concerns earlier this month that the AI company was increasing its reliance on Google Cloud hardware. The renewed commitment shows that AWS remains an important partner, especially for large-scale training runs where capacity and performance are paramount.

While financial terms weren’t disclosed, the new agreement likely represents a multi-billion-dollar contract. For AWS, that translates into predictable, long-term demand from one of the most prominent names in AI. For Anthropic, access to Trainium 2 hardware offers scalability and flexibility to push Claude’s next iterations faster to market.

Trainium 2 Chips Cement Amazon’s Vertical Integration Strategy

Trainium 2 is the backbone of Amazon’s AI hardware strategy. By designing its own chips, AWS reduces dependence on Nvidia’s (NVDA) GPUs and can better optimize workloads across its ecosystem. The chips are engineered to deliver up to four times the performance of their predecessors and integrate directly with AWS’s SageMaker training tools.

This in-house capability means Amazon can capture more of the AI value chain, from infrastructure to inference. It’s a direct challenge to Nvidia’s dominance and a signal that Amazon aims to be a full-stack AI provider, not just a cloud platform. Analysts see this move as crucial for sustaining AWS margins while expanding its competitive moat in enterprise AI.

Earnings Could Reveal the Real Impact of Amazon’s AI Push

Amazon will report earnings after the bell on Thursday, and investors will be watching closely for clues about AWS growth. The Anthropic announcement effectively fuels a stronger AI narrative heading into the results. Analysts expect the company to highlight backlog growth, Trainium adoption, and early signs of improved profitability from its AI infrastructure build-out.

Recent forecasts from Citigroup (C) and Bernstein suggest AWS could re-accelerate into double-digit growth next year as AI workloads ramp. With Project Rainier now operational and a deep-pocketed customer like Anthropic locked in, the outlook for cloud margins looks brighter than it has in years.

How Does this Impact Amazon?

The partnership gives Amazon a clear win in the AI infrastructure race and adds another pillar of confidence for investors ahead of earnings. Anthropic’s expanded commitment offsets concerns about its deals with Google and proves that AWS can still attract, and retain, the most demanding AI clients.

Amazon’s $8 billion investment in Anthropic now looks far more strategic than speculative. As Anthropic’s valuation climbs to $183 billion and its compute needs expand, AWS stands to benefit directly. In the near term, that could mean sustained AI-driven upside for Amazon stock, even as the broader cloud market normalizes.

Is Amazon Stock a Good Buy?

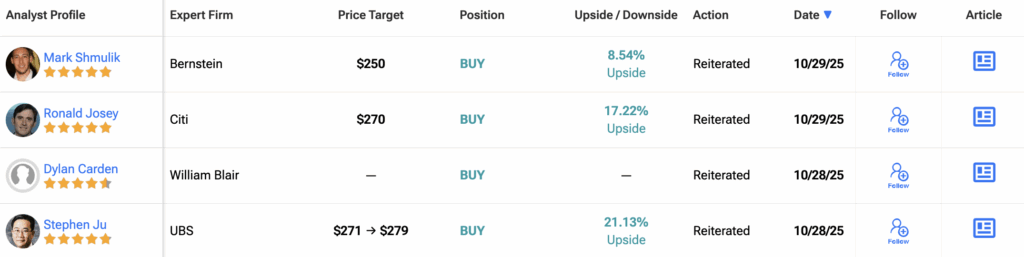

Wall Street analysts remain firmly optimistic on Amazon. Based on 41 recent ratings, every single analyst calls the stock a Buy, giving Amazon a rare unanimous “Strong Buy” consensus.

The average 12-month AMZN price target sits at $269.24, implying roughly 19% upside from the latest close.

First Appeared on

Source link