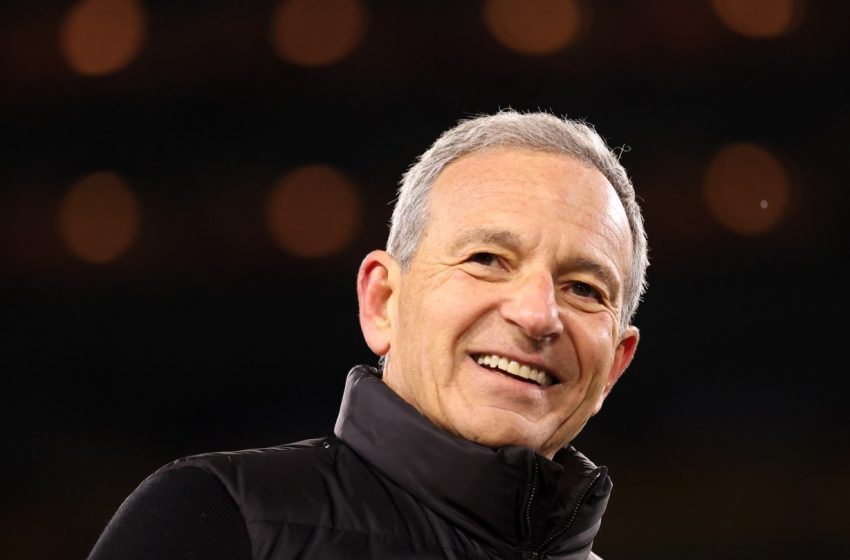

Bob Iger’s Potential Final Earnings Delivers Win for Disney

With a succession decision expected in the very near future, The Walt Disney Co. delivered a Wall Street beat in its latest quarter, a hard-earned win and perhaps even a sendoff for CEO Bob Iger, who is widely expected to step aside in the coming months, ahead of his end of 2026 contract expiration (Josh D’Amaro, Disney’s experiences chairman, is seen as the internal favorite to succeed him).

It is not clear whether Iger will stay with the company in some other capacity like with a board seat after he steps aside as CEO.

“We are pleased with the start to our fiscal year, and our achievements reflect the tremendous progress we’ve made,” Iger said in a statement tied to earnings. “We delivered strong box office performance in calendar year 2025 with billion-dollar hits like Zootopia 2 and Avatar: Fire and Ash, franchises that generate value across many of our businesses. “As we continue to manage our company for the future, I am incredibly proud of all that we’ve accomplished over the past three years.”

On the earnings call, Iger was asked about his own elevation to CEO, both his original promotion, and his return three years ago, and what it could imply as he prepares to step aside.

“I think what is noteworthy is that when I came back three years ago, I had a tremendous amount that needed fixing. But anyone who runs a company also knows that it can’t just be about fixing. It has to be about preparing a company for its future and really putting in place, taking steps to create opportunities for growth so well,” Iger told the analysts. “The good news is that the company is in much better shape today than it was three years ago, because we have done a lot of fixing, but we’ve also put in place a number of opportunities, including the investment across our experiences business to essentially expand at every location that we do business and on the high seas.”

“I also believe that in a world that changes as much as it does that in some form or another, trying to preserve the status quo is a mistake, and I’m certain that my successor will not do that,” Iger added. “So they’ll be handed, I think, a good hand in terms of the strength of the company, a number of opportunities to grow and and also the exhortation that in a world that changes you also have to continue to change and evolve as well.”

Disney delivered revenue of $26 billion in the quarter, its fiscal Q1, with segment operating income of $4.6 billion and adjusted earnings per share of $1.63. The street had projected revenue of $25.6 billion and adjusted EPS of $1.58.

A strong film slate in the quarter and a streaming business that continues to grow bolstered Disney’s entertainment division, while experiences delivered record revenues and operating income.

Entertainment revenues were $11.6 billion, with operating income of $1.1 billion, an increase of 7 percent and a decline of 35 percent year-over-year, with the YouTube TV blackout and higher costs offset by a strong theatrical slate and improvements in streaming. The success of the latest Avatar film will also flow into the current quarter.

Streaming revenues were $5.3 billion, with operating income of $450 million, up substantially from a year ago. Fiscal Q1 was the first quarter in which Disney stopped disclosing streaming subscriber numbers. The company ended its last quarter with 132 million Disney+ subscribers, and 196 million Disney+ and Hulu subscribers, with revenue growth this quarter suggestive of further adds, perhaps paired with higher prices.

On the call, Iger outlined how the company’s deal with OpenAI for Sora-generated videos will work.

“We have for a while wanted to include or add a feature on Disney+, as ESPN did, by the way, in its new offering, that is both user generated, but more importantly, short form,” Iger said. “ESPN is short form, because we have obviously noticed the huge growth in short form and user generated content on other platforms such as such as YouTube. So what this deal does is by giving us the ability to curate what has been basically created by Sora onto Disney+, it jumpstarts our ability to have short form video on Disney+, additionally, it’s our hope that we will use the Sora tools to enable subscribers of Disney+ to create short form videos on our platform through Sora, so it’s all, I think, a positive step in terms of adding a feature that we believe will greatly enhance engagement.”

Experiences revenues cracked $10 billion, with operating income of $3.3 billion, as guests spent more and with Disney’s cruise ships operating at a higher capacity.

In sports, revenues were $4.9 billion, with operating income of $191 million.

According to Disney’s 10-Q, the company closed its deal for the NFL to acquire a 10 percent stake in ESPN in January, a deal that carries an estimated fair value of $3 billion, per the company. Disney also disclosed that it has the right to buy back the NFL’s stake beginning in July 2034, “in exchange for a ten-year note at 70 percent of the then fair market value of the NFL’s interest in ESPN,” while the league has an option to acquire an additional 4 percent of ESPN at 70 percent of fair market value.

That said, there were also some cracks showing. The extended YouTube TV blackout of Disney’s channels, most notably ABC and ESPN, had an adverse impact on operating income of $110 million, and was reflected in the sports division, which saw operating income decline 23 percent compared to last year.

And while the company reaffirmed its guidance, it warned of higher costs at experiences due to new attractions and cruise ships, as well as “international visitation headwinds at our domestic parks.”

In entertainment, the company projects segment operating income in its fiscal Q2 to be comparable to a year ago, while streaming income is expected to rise to $500 million. For the year, the company projects double digit operating income growth in the segment, weighted to the second half, and streaming margins of 10 percent.

Sports is expected to have low single digit operating income growth for the year, with a slight decline in Q2 due to higher expenses.

And while experiences is expected to have modest operating income growth in fiscal Q2, the company still projects high single digit growth, weighted toward the back half of the year.

On the call, Iger was bullish about the division’s long-term potential, noting that when he was first promoted, it was struggling somewhat.

“As we added IP to our stable, including Pixar in ’06 and Marvel in ’09 and Lucasfilm, Star Wars in ’12, and ultimately 20th Century Fox, we gained access to intellectual property that had real value in terms of parks and resorts and enabled us to lean into more capital spending because of the confidence level we had in improving returns on invested capital due to the popularity of that IP,” Iger said. “When you look at the footprint of the business today, it’s never been more broad or more diverse, and the projects that we have underway are going to make it even more so. As I said, we’re expanding in every place we operate, and additionally, having been in Abu Dhabi just two weeks ago, I was reminded how great the potential is to build in that part of the world is not only is it strategically located to reach a huge population that has never visited our parks, but we built in one of the most modern and technologically advanced ways. So you know, as I look ahead, I actually am very, very bullish on that business and its ability to grow.”

First Appeared on

Source link