Chief investor urges people to quit chasing AI, says it’s not a matter of if but when it ‘breaks’ — how to prepare

If you’re invested in AI, you might want to pay attention.

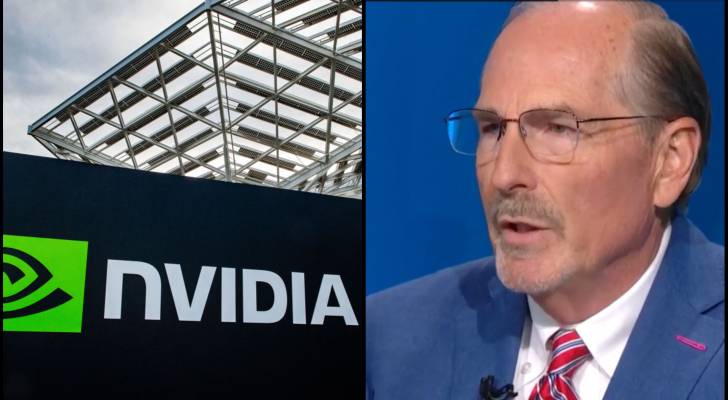

Bill Smead, founder of Smead Capital Management, says the market frenzy around AI has all the signs of a bubble, driven by the momentum of stocks like Nvidia.

“We’re in the crazy stage,” Smead told Business Insider, comparing today’s market to the eve of the dot-com crash in late 1999. (1)

He points to valuations he feels are untethered from reality.

Since early 2023, Nvidia’s value has jumped twelvefold to $4.4 trillion, while Palantir has skyrocketed twenty-eight-fold to $420 billion.

Meanwhile, AI firm CoreWeave’s valuation just hit $60-billion on just $1.2 billion in quarterly revenue.

“We’re bumping up against history real hard now,” he warns, especially worried about many Americans have household wealth tied to Big Tech.

Here’s what you should know to avoid taking a hit.

Smead said AI firms’ potential success is overcapitalized and predicted that “when this thing breaks,” stocks could trade at a fraction of current prices.

That would have a domino effect in U.S. equity markets that are already heavily weighted in the technology sector. Reuters notes that the sector’s value makes up 34% of the S&P 500, higher than the peak concentration in March 2000. (2)

Read more: Robert Kiyosaki warns of a ‘Greater Depression’ coming to the US — with millions of Americans going poor. But he says these 2 ‘easy-money’ assets will bring in ‘great wealth’. How to get in now

Smead says AI stocks could see a 40% drop in value daily as occurred in the dot-com bust.

“That is going to be spooky,” he said.

He and other market observers are concerned about another development that harkens back to the dot-com bubble: increasing ties between major players. Case in point? Nvidia’s plan to invest up to $100 billion in OpenAI.

When companies invest in one another and share customers, it creates ‘circular’ financing — a self-reinforcing feedback loop.

Paulo Carvao, a senior fellow who researches AI policy at the Harvard Kennedy School told Bloomberg that the same thing happened in the late 1990s. At that time, he said, startups made circular deals around advertising and cross-selling. (3)

First Appeared on

Source link