Microsoft’s (MSFT) Q1 Earnings Tomorrow: Options Market Braces for a 4.75% Move

Microsoft (MSFT) is set to report its fiscal Q1 earnings tomorrow, October 29, after the market closes. Wall Street is bracing for a potential 4.75% swing in the stock, according to options pricing. This is higher than Microsoft’s long-term average post-earnings move of -0.36%, which reflects a modest decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This implied move reflects both AI-driven optimism and execution risk. As part of the ‘Magnificent 7’ tech stocks, Microsoft faces high expectations, so any miss could trigger volatility.

This quarter, investors are likely to watch more than just the top and bottom lines. The focus is expected to be on Microsoft’s AI monetization capabilities, especially after its partnership with OpenAI (PC:OPAIQ). Also, investors would want an update on Azure’s performance and Copilot adoption rate.

Expectations From MSFT’s Q1 Results

Wall Street is expecting MSFT to report earnings of $3.67 per share, up 11.2% from the same period last year. Also, analysts project revenues of $75.38 billion, up from $65.59 billion in the year-ago quarter.

Ahead of the earnings release, Mizuho analyst Gregg Moskowitz reiterated a Buy rating and $640 price target on Microsoft stock. He is optimistic about the tech giant’s medium- and long-term growth potential, especially as AI adoption and monetization continue to accelerate.

He called the new restructuring deal with OpenAI a “win-win,” preserving Microsoft’s revenue share, IP rights, and Azure exclusivity until AGI is reached. MSFT also gains nearly a 27% stake in OpenAI.

Is MSFT Stock a Buy?

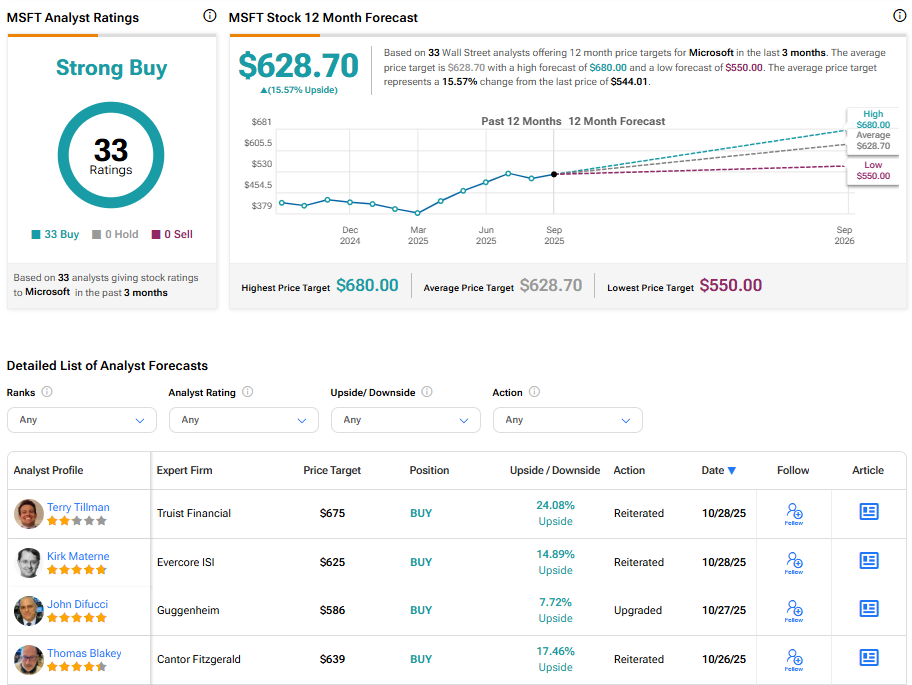

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 33 Buys assigned in the last three months. Further, the average MSFT price target of $628.70 per share implies 15.57% upside potential.

First Appeared on

Source link