Vaccine makers feel a chill as US Health Secretary Kennedy’s rhetoric becomes reality

Sign up here.

“Vaccines will not be a growth area under the current administration,” said Stephen Farrelly, global pharma and healthcare lead at ING, signaling a potential drag on the sector through 2028.

VACCINE POLICY UNDER KENNEDY

Kennedy, a longtime anti-vaccine activist who has cast doubt on the safety and efficacy of vaccines contrary to scientific evidence, has moved quickly since taking over the Department of Health and Human Services under Trump.

He also revived research into a long-ago debunked claim linking vaccines to autism, and adopted new reduced childhood vaccine schedules without the long-standing practice of involving a broad group of outside experts.

Investors and analysts initially saw Kennedy’s appointment as a headline risk, rather than a fundamental threat.

Kennedy says the changes aim to improve safety and bring U.S. vaccine policy in line with other peer nations.

A HHS spokesperson said in a statement that vaccine recommendations are based on the best available “gold-standard scientific evidence and public health considerations, not corporate interests.”

The striking policy changes have begun to prompt some rare public rebukes from industry leaders.

Bourla told reporters it was driving down vaccination rates and increasing disease risk. “I’m seriously frustrated,” he said. “What is happening has zero scientific merit and is just serving an agenda which is political and antivax.”

POLITICAL PRESSURE STARTS TO BITE

The long-term prospects for vaccine makers remains robust, investors said, as vaccines are still the most effective tool for preventing disease. But they said companies were now more beholden to the whims of political leaders.

“Unfortunately, success and failure will rest on the opinions of a few people. It’s not enough to have good science and commercial opportunity,” said Clear Street analyst Bill Maughan. “If you’re a biotech investor, it just seems tough to really get conviction in a vaccine name right now.”

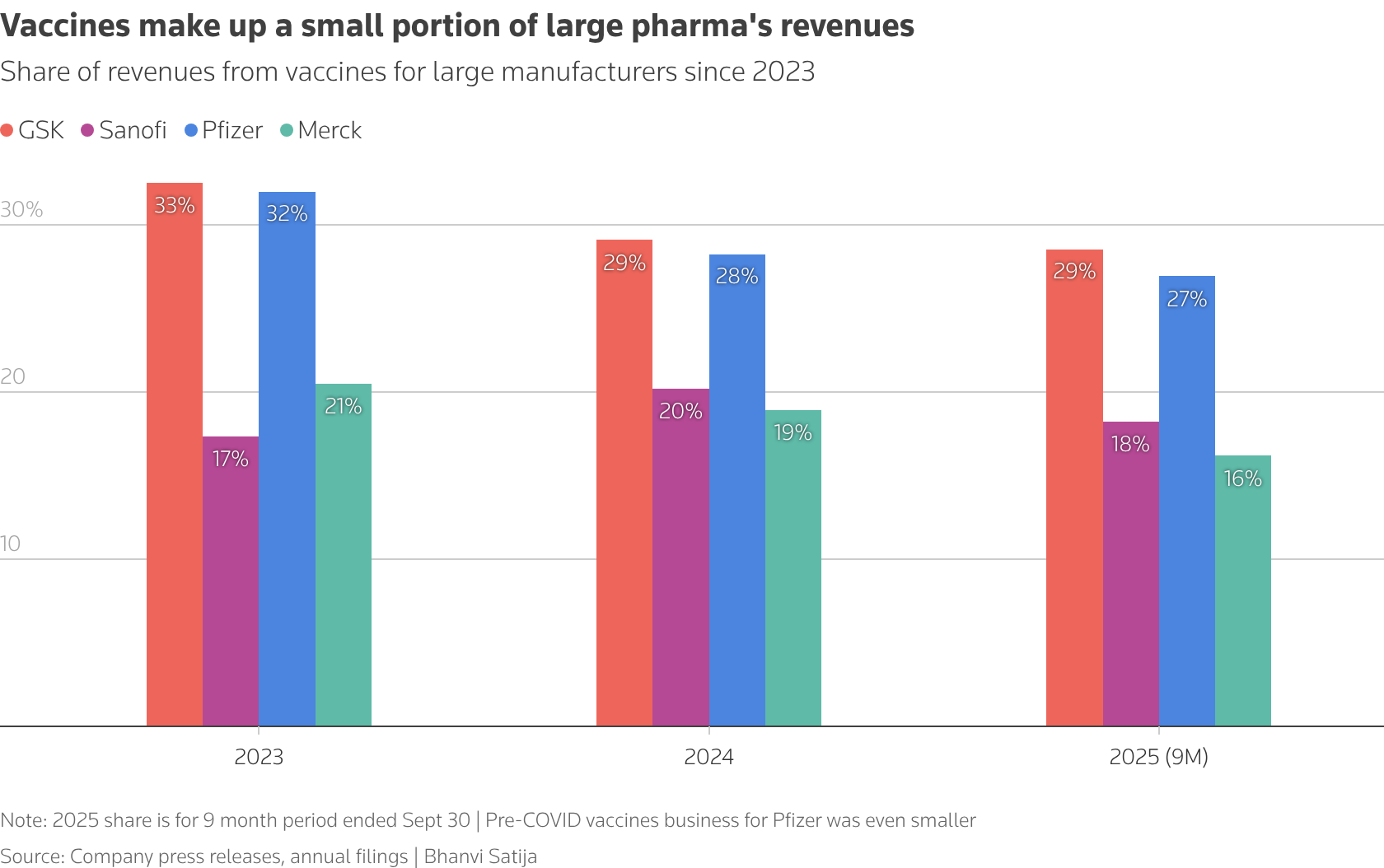

Investors said they would stick by large-cap drugmakers less dependent on vaccine revenue such as GSK, Sanofi, Pfizer and Merck. Smaller players like Moderna, BioNTech and Novavax face sharper risks.

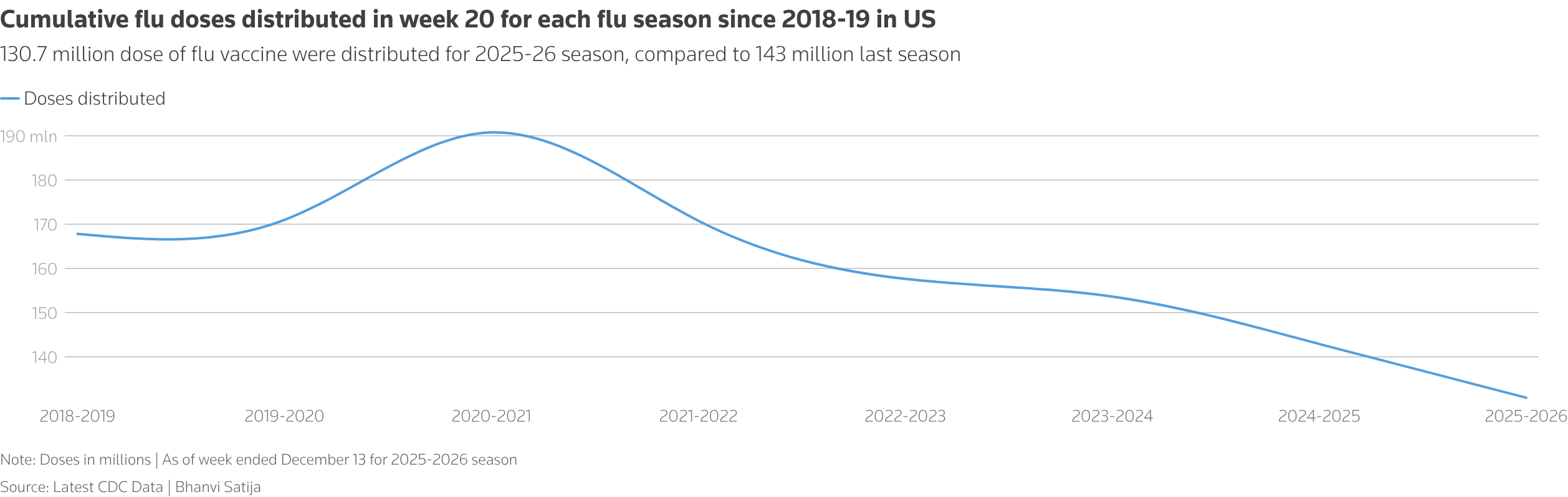

The effect of U.S. changes are already starting to take hold. GSK and Sanofi reported lower U.S. flu vaccine sales in the third quarter, despite a more severe flu season.

“There’s clearly consumer reaction to the narrative that is coming out in the United States,” said Jefferies analyst Michael Leuchten.

LONG-TERM VIEW

The U.S. Centers for Disease Control and Prevention recently said the 2025–26 flu season had seen at least 11 million cases and 5,000 deaths reported so far, nearly double last year’s toll.

Investors “often focus on shorter-term time frames, while companies clearly take a far longer-term view,” said Linden Thomson, senior portfolio manager at asset management firm Candriam.

“These businesses have been around for decades. They don’t invest on a one- or two-year horizon,” agreed Matthew Masucci, an analyst for Callodine Capital, which owns GSK and Sanofi shares.

But for now, investors may be more cautious.

Whipsawing U.S. policy and vaccine scepticism is a drag on investment, said Ian Turnbull, an equity analyst at investment firm Mawer.

“It does make it a less attractive market to invest in if your demand isn’t predictable like it used to be,” he said.

Reporting by Bhanvi Satija; Additional reporting by Maggie Fick in London and Michael Erman in New York; Editing by Adam Jourdan, Michele Gershberg and Bill Berkrot

Our Standards: The Thomson Reuters Trust Principles.

First Appeared on

Source link