Wall Street braces for Monday meltdown that could ‘knock the wheels off’ the stock market

President Donald Trump’s threat of additional 100 percent tariffs on China has Wall Street bracing for chaos when markets reopen Monday.

More than $2 trillion was wiped off US stocks Friday after Trump announced the tariffs in response to Beijing’s new export restrictions on rare earth metals, a move that could cripple US technology companies.

The real crash, analysts warn, may not have even started. Stock trading closes for the weekend on Friday nights and does not resume until Monday morning.

Investors are bracing for panic selling. ‘This isn’t the first time we’ve seen a bump in the road since April, but this seems like a significant one. Like one that could knock the wheels off,’ said Art Hogan, chief market strategist at B. Riley Wealth Management.

Meanwhile, Wedbush Securities analyst Dan Ives wrote to clients: ‘This step up in tensions has created a white-knuckle moment for the markets with tech stocks under major pressure.’

The panic shows just how fragile the rally has become. ‘Bull markets don’t die of old age,’ said Sam Stovall, chief investment strategist at CFRA Research. ‘They die of fright — and this one has every reason to be scared.’

The first signs of whether the selloff will continue — and how severe it could be — will come Sunday night when Asian markets open, including Japan’s Nikkei at 8pm ET.

There was hope a major sell off will be avoided when US futures began trading at 6pm ET. They opened slightly higher than Friday’s close, but well down on where they were before Trump’s tariff threat.

Donald Trump, left, shakes hands with China’s President Xi Jinping during a meeting on the sidelines of the G-20 summit in Osaka, Japan, June 29, 2019

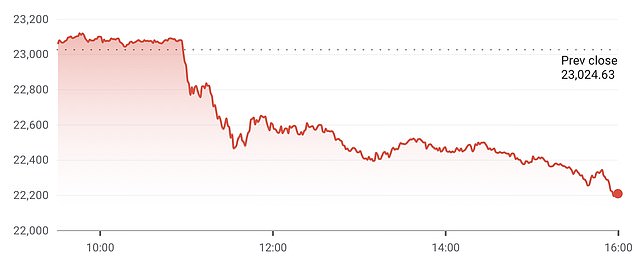

The Nasdaq tumbled 3.7 percent on Friday – its worst day since Trump’s ‘Liberation Day’ tariff announcements in April

Futures let investors bet on where major stock indices — like the S&P 500 and Dow Jones — will move in the days ahead. They trade when regular markets are closed, offering a real-time snapshot of investor sentiment.

There were hopes Sunday afternoon that Trump might be using the threat as a negotiating tool, rather really planning to add an additional 100 percent tariff on goods from China.

On Truth Social, he wrote: ‘Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The US wants to help China, not hurt it!!!’

The turmoil had begun Friday morning in Beijing. China announced new export restrictions on rare earth minerals — metals crucial for fighter jets, electric vehicles, semiconductors, and AI chips.

The country controls about 70 percent of the world’s supply and nearly all global processing capacity, giving it enormous leverage over the high-tech economy.

Trump hit back on Friday, announcing a 100 percent tariff on all Chinese goods. He said he was ‘surprised’ Beijing would take such a step given his ‘good relationship’ with President Xi Jinping. The tariffs, he added, would take effect November 1 and come on top of existing duties — a direct escalation of the US-China trade war.

Markets plunged. The S&P 500 sank 2.7 percent, its worst single-day drop since April’s tariff chaos. The Nasdaq tumbled 3.6 percent, while the Dow fell nearly 2 percent.

Adding to the panic, the crypto market imploded Friday night. Bitcoin dropped more than 10 percent, while Ether and Solana plunged even deeper. Leveraged traders lost a record $19 billion, and nearly $400 billion in total crypto value vanished in hours.

Tech stocks, the darlings of 2025’s rally, were hammered. The S&P tech sector fell 4 percent, led by steep losses in chipmakers like Nvidia, Super Micro Computer, and Synopsys — all vulnerable to rare earth supply disruptions

There are fears the China tariffs will lead to price rises for common items sold in the US

Workers use machinery to dig at a rare earth mine in Ganxian county in central China’s Jiangxi province. China dominates the global rare earth supply chain, and the US is heavily dependent on imports

More than $2 trillion was wiped off US stocks Friday after Trump announced the tariffs in response to Beijing’s new export restrictions on rare earth metals, a move that could cripple US technology companies.

Tech stocks, the darlings of 2025’s rally, were hammered on Friday, led by steep losses in chipmakers like Nvidia, Super Micro Computer, and Synopsys, all vulnerable to rare earth supply disruptions.

The selloff spread to smaller banks and industrial firms, reflecting fears that renewed trade tensions could push the US economy toward recession.

Friday’s collapse erased months of momentum; the S&P 500 had climbed more than 30 percent since April, hitting record highs as investors shrugged off earlier tariff threats.

The CBOE Volatility Index, Wall Street’s fear gauge, jumped nearly 30 percent, signaling deep anxiety about a prolonged trade war.

The rare earth fight is already spilling into geopolitics. China’s new rules require special approval for companies exporting any product containing even trace amounts of Chinese-processed minerals.

Defense-related exports are expected to be blocked outright. Analysts say the move is designed to pressure Washington while Beijing flexes its dominance in the global supply chain.

For investors, it’s a stark reminder that the post-pandemic bull run was built on fragile ground.

First Appeared on

Source link