Why AMD Stock May Overextend in its AI War with Nvidia (NVDA)

Advanced Micro Devices’ (AMD) aggressive push into the artificial intelligence (AI) market has reached epic levels. In a direct challenge to Nvidia’s (NVDA) undisputed dominance in the AI accelerator market, AMD has unveiled two blockbuster deals in October that signal its ambition to become a formidable competitor.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

First, a multi-year, six-gigawatt partnership with AI pioneer OpenAI, followed by a multi-year collaboration with cloud computing giant Oracle (ORCL) to build the first publicly available AI supercluster powered by 50,000 AMD GPUs. AMD’s latest landmark deals can reshape a market. However, a closer look at the terms, particularly the “sweetened” OpenAI deal, begs the question: Is the semiconductor market-challenger making a savvy strategic investment in its future, or is it paying too high a price to sit at the table with the giant(s)?

For investors, the answer lies in balancing the company’s bold vision against the monumental task of chipping away at Nvidia’s fortress and Broadcom’s increasing clout. Even as a proud AMD shareholder, I believe that, despite its recent momentum, the semiconductor stock deserves a Hold rating, for the time being.

The Steep Price of Admission

AMD’s deal with OpenAI is more than a simple supply agreement; it’s a deep strategic alliance. To secure this partnership, AMD has issued OpenAI warrants to purchase up to 160 million shares of its common stock (potentially close to 10% of its equity) as deployment and performance milestones are met.

While this deal’s structure creates a powerful incentive for ChatGPT developer OpenAI to be highly invested in the success of AMD’s hardware, it contrasts sharply with competitor deals in the space. It suggests that to break into this exclusive market, AMD needed to offer more than just competitive silicon. This isn’t necessarily a sign of weakness, but rather a reflection of a different strategic priority: using equity as a tool to lock in a flagship customer (or perhaps a key sales representative) and gain the credibility needed to challenge an incumbent.

Advanced Micro Devices has recruited an expensive sales representative in OpenAI, and an equity incentive was befitting to retain this “hottest talent” who’s helping the world embrace AI. OpenAI could push AMD’s AI equipment into dozens of global AI data centers before it cashes in on its lucrative warrants.

AMD’s market challenge is underscored by Oracle’s two October 14 deals. While committing to an initial 50,000 AMD GPUs starting in the third quarter of 2026 (Q3 2026), Oracle also detailed a massive, multi-gigawatt project. This project, built in collaboration with OpenAI, uses Nvidia’s AI infrastructure to develop its “Zettascale10” clusters for the AI cloud, targeting the deployment of 800,000 Nvidia GPUs.

Oracle’s unreserved praise for Nvidia’s “industry-leading price performance” in its own announcement serves as a stark reminder of the uphill battle AMD faces. It has won a foothold, but the war for market territory is just beginning.

AMD’s Financial Health and Future Growth

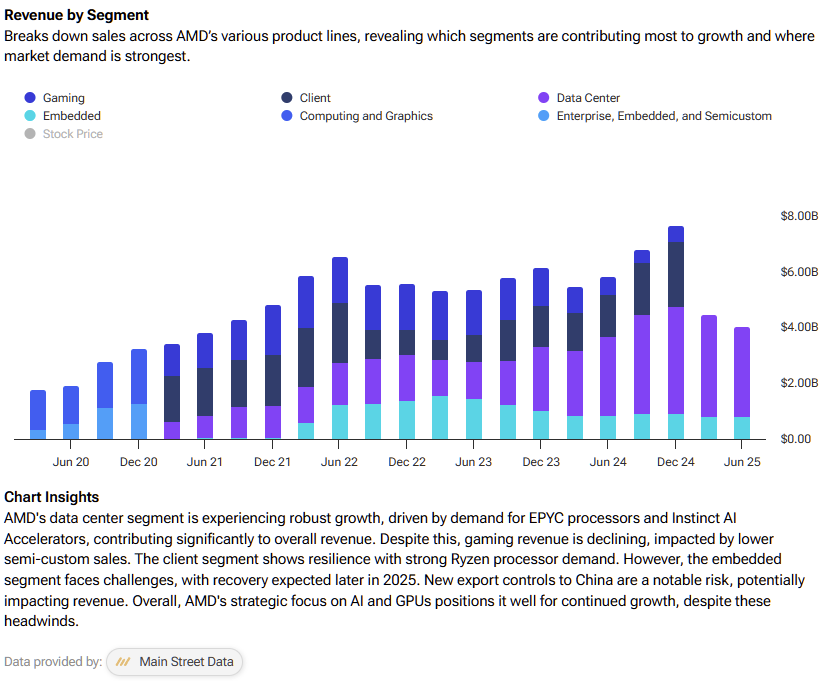

AMD’s upsized AI ambitions are built on a solid, if recently challenged, financial foundation. The company recently changed its segment reporting by merging two previously separate segments, Client and Gaming. Its second-quarter 2025 results were a mixed bag. The Data Center segment was hit by an $800 million inventory charge related to U.S. export controls on shipments to China, which dragged down gross margins significantly – from 49% to 39.8%.

Ironically, the AI GPUs that were meant to accelerate AMD’s revenue growth rate actually dragged its corporate operating income statement into the negative. Geopolitics happen. The Data Center segment’s operating margins plunged from 26% a year ago to a negative 5% in Q2 2025. This segment needs a boost, and recent Oracle and OpenAI deals may give it the spark it needs to make investors happy.

While the company planned to resume Instinct MI308 chip shipments to China upon U.S. authorization, its guidance for Q3 2025 revenue provided in August left out such potential sales to the Asian country.

However, looking past the (hopefully one-time) geopolitics-induced charge, the bigger picture is brighter for AMD. The Client and Gaming segment saw revenues surge 69% year-over-year, driven by price increases and strong demand for its latest Ryzen processors and higher semi-custom sales. This underlying strength in a core business segment that usually suffers from recurring demand cycles is reassuring. Gaming is back in the growth game again, and the server business is booming again, providing AMD with the cash flow and financial stability it needs to fund its long-term, capital-intensive push into the AI space.

Management’s guidance for the third quarter (Q3 2025) remained optimistic, projecting a 28% year-over-year revenue growth and a healthy non-GAAP gross margin of 54%. While significant revenue from the OpenAI and Oracle deals won’t materialize until the second half of 2026, these agreements provide a crucial long-term growth catalyst that the market can begin to price in.

AMD’s Valuation Stretches Thin Ahead of Q3 Earnings Test

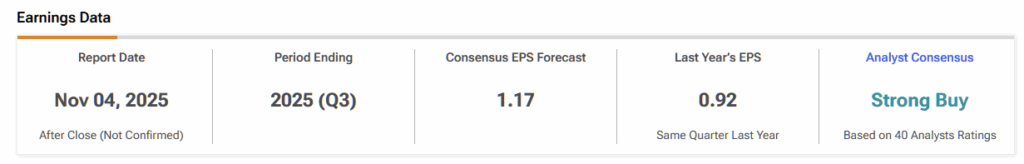

The recent 50% spike in AMD’s share price has taken the stock into overpriced territory. Shares seem too expensive at a forward P/E of 95x, which is more than double Nvidia’s 41x. Given the small challenger’s history of wild price swings, AMD stock could see weakness around November 4th if its Q3 2025 earnings report disappoints.

Is AMD a Buy or Sell Now?

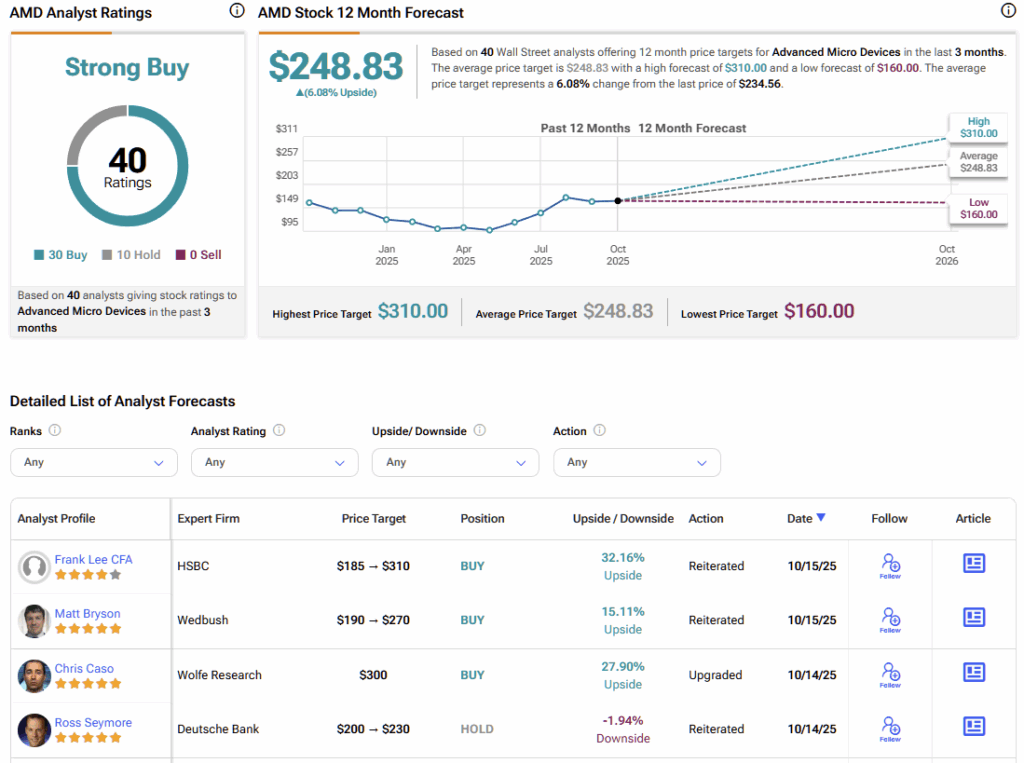

Wall Street analysts are bullish on Advanced Micro Devices. AMD stock carries a consensus Strong Buy rating based on 30 Buys and 10 Hold ratings by leading analysts during the past three months. Currently, AMD stock has an average stock price target of $248.83, implying more than 6% potential upside over the next twelve months.

AMD’s Strategic Wins Set the Stage as Execution Defines What’s Next

AMD is making smart, strategic moves. The company has forged partnerships with major players across the AI and cloud computing ecosystems—validating its technology and setting up a clear path toward gaining meaningful ground in the AI accelerator market.

That said, the journey ahead won’t be easy. Nvidia remains a fast-moving target, and the inclusion of warrants in the OpenAI deal underscores the competitive barriers AMD still faces. Meaningful revenue contributions from these partnerships are likely almost two years away, leaving plenty of room for market conditions to evolve.

Given that, I’d rate AMD a Hold for now. It’s one of the most compelling challenger stories in tech, but the stock price already reflects much of the optimism around its recent strategic wins. Investors should watch closely to see whether AMD can turn these deals into measurable financial performance before taking a more bullish stance. The potential is enormous—but so is the execution risk.

First Appeared on

Source link