Xbox FY26 Q1 earnings up despite hardware decline

Microsoft’s Q1 for the fiscal year of 2026 press release is now live, with Xbox seeing another steep decline in hardware and a small gain in Content and Services revenue that beat their projected numbers.

The Xbox hardware division continues its decline as fewer units are shipped and sold at retailers. Hardware dropped by 29% year over in in Q1 FY26. To our surprise, the Content and Services revenue grew, despite the following guidance given to us by Microsoft CFO Amy Hood from the Q4 FY25 conference call with investors:

Guidance for next quarter: Total decline mid to high single digits (4-9%) against a strong prior year comparable. Content and Services to decline in mid single digits (4-6%)

Content and Services instead rose by 1%, a 5 to 7% increase over Microsoft’s projected results. It was primarily driven by growth in Game Pass subscriptions, and offset by a decline in first-party revenue. Last year’s Q1 saw a 61% growth due to the full integration of ABK, following the FTC’s losing their attempt to block the acquisition.

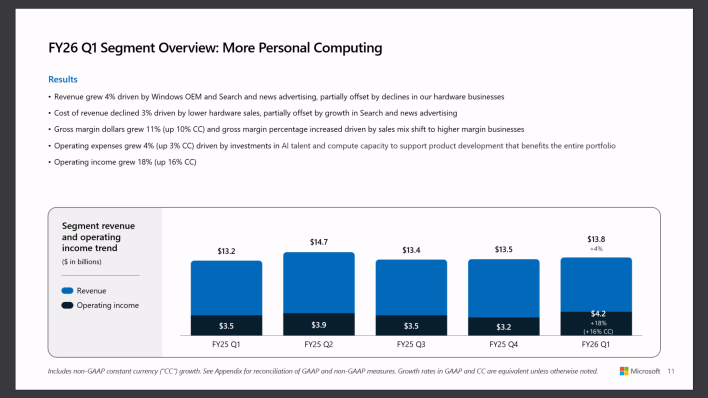

Personal Computing, which Xbox is a part of, saw an 18% increase YoY in operating income. With Amy Hood’s main metric for the company being margins, this would seemingly be a positive result.

Satya Nadella on Microsoft Gaming:

Across every endpoint focused on our high-margin content and services, we launched critically acclaimed games like Keeper, Ninja Gaiden 4, and The Outer Worlds 2, reaching 155 million monthly active users in Minecraft, an all-time high and set (a) new record for overall content and services revenue for the quarter. We also saw a great response to the Xbox Ally launched two weeks ago and set new records for players on pc.

Amy Hood on Microsoft Gaming:

Revenue was $13.8 billion and grew 4% windows OEM and devices. Revenue increased 6% year over year, significantly ahead of expectations driven by strong demand ahead of Windows 10 end of support, as well as a benefit from inventory levels that remain elevated. Search and news advertising revenue T increased 16% and 15% in constant currency driven by growth in volume, as well as a continued benefit from third party partnerships. That was better than expected. And in gaming revenue decreased 2% and 3% in constant currency against a strong prior comparable Xbox.

Content and services revenue increased 1% and was relatively unchanged in constant currency driven by better than expected performance from third party content segment. Gross margin dollars increased 11% and 10% in constant currency and gross margin percentage increased year over year. Driven by sales mix shift to higher margin businesses, operating expenses increased 4% and 3% in constant currency, and operating income increased 18% and 16% in constant currency. Operating margins increased three points year over year to 30% driven by the higher gross margin noted earlier.

And in Xbox content and services, we expect revenue to decline the low to mid single digits against a prior year comparable that benefited from strong first party performance, partially offset by growth in subscriptions and hardware. We expect similar declines in hardware revenue.

Here are the links directly to Microsoft’s reports: Statement, Webcast, and PowerPoint Slides for FY26 Q1

How do you feel about Xbox’s current direction vs. its financial targets? Let us know in the XboxEra Forums or make some noise in the lively XboxEra Community Discord Server. If you’re looking to be a bigger part of an amazing community, then either choice is a good one!

XboxEra is a community-first, community funded publication. If you value what we do, and want to have a direct say in what we cover, consider supporting us directly on Patreon.

All you need to do is head on over to patreon.com/xboxera and pledge your support. You’ll find that we create more content than many other Patreon supported publications, and we give more back in return. Make a difference and keep your favourite independent Xbox-focused publication alive! We appreciate your support.

Article updated with quotes from Satya Nadella and Amy Hood

First Appeared on

Source link