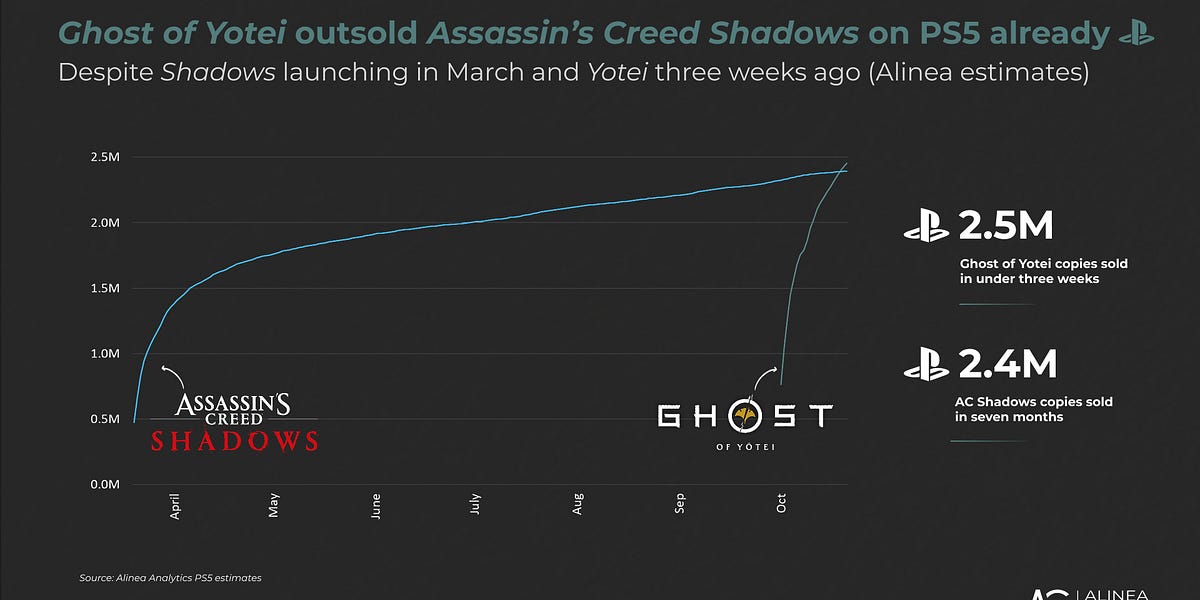

Ghost of Yotei outsold Assassin’s Creed Shadows on PS5 in under three weeks

After seven months on the market, Assassin’s Creed Shadows has sold less on PS5 (2.4M) than Ghost of Yotei did (2.5M) in under three weeks, showing that this samurai showdown is just about settled.

Across all platforms, Shadows performed well in isolation, selling just over 4.3M copies as per our estimates, with 56% on PS5, 26% on Xbox, and 18% on Steam:

However, context matters here. Ubisoft needed a breakout hit to reinvigorate its core franchise. Shadows has instead had a lukewarm sales performance shortly after Ubisoft announced it’s putting all its eggs in the Assassin’s Creed– and Far Cry-shaped baskets.

Ghost of Yotei, meanwhile, has managed to quickly and effectively capture the same audience Shadows was aiming for – within the PlayStation, at least. And it did so faster, with broader enthusiasm and stronger word of mouth:

So why did it take three weeks for Yotei to sell 2.5M on PS5 but Shadows seven months to hit 2.4M? There are a lot of reasons, so let’s get into it.

One aspect is that a cohort of PS5 players is loyal to the PlayStation brand and buys anything first-party. Yotei was compelling for these players.

Our player crossover estimates show that Yotei players are more likely to have played almost every PlayStation first- and second-party game versus Shadows players. Meanwhile, the crossover share for third-party games is more equal between Yotei and Shadows.

You can see a comparison of the crossover for recent games below, but the trend rings true across most of the relevant games in the PlayStation library (with one big exception, which we’ll get onto later):

Usually, an Assassin’s Creed game’s new setting excites players, like ancient Egypt with Origins, ancient Greece with Odyssey, and the Viking age with Valhalla.

For years, fans begged for Assassin’s Creed to go to feudal Japan. Shadows finally went there, but the open-world samurai fantasy had already been realised elsewhere by PlayStation Studios’ Sucker Punch Productions.

Ghost of Tsushima had already eaten Shadows’ lunch, and laid the groundwork for Yotei to continue the feast.

On a related note, the game’s interpretation of Japan has been somewhat controversial among some Japanese gamers compared to the unanimous praise for the Ghost series in Japan. This led Ubisoft to issue a statement about this feedback.

Our data shows that just 1.6% of Shadows’ audience on PS5 is in Japan, which is lower than expected. For context, Yotei’s share of players in Japan is over triple that.

While Assassin’s Creed Shadows is a great game, boasting impressive technical chops and well-developed stealth mechanics, it arguably leans too heavily on a design template that’s begun to feel predictable.

Ubisoft’s long-running open-world formula – expansive maps, layered RPG progression, and checklist-style objectives – is frankly showing its age for many players. There are diminishing returns. And the bar has been raised.

What once defined the genre now feels overfamiliar, especially in a post-Elden Ring and Breath of the Wild world where discovery and experimentation have become the new expectations.

On that note, almost half of Yotei’s PS5 players also played Elden Ring. That number is 37% for Shadows’ players, making Elden Ring one of the few third-party games that Yotei players markedly play more.

Compared to Shadows, Ghost of Yotei and its predecessor took way more cues from the Breath of World school of design, building a more diegetic world (the wind is a waypoint for quests, for example).

This approach builds curiosity and keeps the player immersed, rather than overwhelming the player with icons, checklists, and busywork. Shadows sticks closer to tradition.

In Yotei, exploration is intuitive and rewarding, combat is impactful and cinematic, and its revenge story feels focused and emotionally resonant, if a little predictable and well-trodden.

There’s also a question of identity. Ghost of Yotei knows exactly what it is – a grounded, cinematic action-adventure rooted in Japanese myth and emotion.

Assassin’s Creed, on the other hand, continues to grapple with what it wants to be: a stealth series, an action RPG, a live-service platform – or all three.

Looking ahead, Yotei has its Steam port on the horizon. Ghost of Tsushima came to Steam last year and has passed 2M copies sold on the platform ($90M+ in revenues).

Even that, based on a then-four-year-old game, is selling better than Shadows is on Steam. When Yotei hits Steam, which we expect to happen in 2026 as a simultaneous launch with the Yotei Legends PvE mode, we’re expecting an even bigger bump for the Ghost franchise.

I have a theory that Yotei Legends launch is going to be a bit of a dark horse when it launches on both platforms in 2026. PvE and co-op is hot right now, especially on Steam, and Sony wants another Helldivers 2 situation.

Steam was the real catalyst of Helldivers 2’s popularity and accounts for the vast majority of its players (and spenders). We have data that shows these things, and so does PlayStation. It knows the strategy worked for Helldivers 2.

Speak of the devil…

Our estimates show that Helldivers 2 is very close to 20M copies sold, including 12.6M on Steam, 5.4M on PS5, and 1.4M on Xbox.

We caught some fire from hobbyists on Twitter back when we announced our Helldivers 2 numbers back in August, as the title didn’t chart in the top 10 on a third-party vendor’s top 10 chart.

We were confident in our estimates, arguing that we don’t comment on the methodology of others.

But we also underlined that when Arrowhead’s CEO reported 500k concurrent players across all platforms, there were around 160K on Steam. Valve’s platform accounted for around two-thirds of Helldivers 2 copies sold at that point. So at least 340k concurrents were on console, and we can assume at least 200K on Xbox.

When the Xbox version of Helldivers 2 launched, we also reported that it was selling faster than the PS5 version. That was true, it’s not true anymore, and there’s important context behind that:

-

Helldivers 2 didn’t start as an instant mega-franchise. Its growth on PS5 was damn good but not as explosive as Xbox.

-

After its first week, sales were a little over 700K copies on PlayStation, compared to nearly 1 million on Xbox.

-

That early Xbox surge was driven by pent-up demand – players who’d been waiting months for access to the game.

-

Since then, Xbox sales have flattened out considerably. Around 57 days post-launch, the Xbox version sits at about 1.4 million copies sold, while the PS5 version had already surpassed 3.5 million in that same timeframe.

The recent Helldivers II revision by the third-party vendor in question shows why we don’t comment on the methodological approaches of other firms. In this instance, the vendor itself even transparently noted from the outset that there might be issues with the data.

On the topic of data transparency, we have also started posting our estimates versus publisher-announced numbers. Transparency is key.

Definitions are critical in this space, too. It’s worth noting that our estimates reflect sell-through (units sold to consumers) on a global basis, not sell-in (including units shipped to retailers).

That distinction can make a significant difference in copies sold, particularly during the initial days after launch.

This is especially true for games that are popular in Japan and published by Japanese companies, like Metal Gear Solid Delta and Silent Hill f. Japan has been slower to transition away from physical media, so shipped copies are still high at launch.

Of course, good judgment is crucial when interpreting estimates, but they should be seen as informed approximations, not absolute figures.

Finally, we do not include user reviews in our methodology for copies sold/player estimates.

In other words, chill out, Twitter…

Want to get your hands on our data for yourself?

We’re offering a free trial of our platform for games companies. Just reach out here, or reply to this email, and we’ll set you up.

Reply to this email – or reach out here – if you have any feedback for the newsletter – or want to request a game for us to cover.

[Alinea Analytics boasts the most accurate PC and console estimates in the business. Game makers use our platform to understand their audience, keep an eye on the competition, monitor sales trends, and spot new opportunities. We equip game studios and financial institutions with accurate data and the confidence to make smarter, data-driven decisions. Want to talk about all things games market data? We’d love to chat!]

First Appeared on

Source link