US data centers’ energy use amid the artificial intelligence boom

Artificial intelligence has developed rapidly in recent years, with tech companies investing billions of dollars in data centers to help train and run AI models. The expansion of data centers has raised questions on several fronts, including the effect these facilities may have on energy and the environment as the United States seeks an edge in the global AI race.

In this analysis, we’ll take a closer look at data centers and what we know about their potential impact in these areas.

This analysis explores the following questions:

What’s a data center?

Data centers are large buildings that house rows of computer servers, data storage systems and networking equipment, as well as the power and cooling systems that keep them running. This infrastructure is essential for companies that provide digital services. Whenever you send an email, stream your favorite TV show, save a family photo to “the cloud” or ask a chatbot a question, you’re interacting with a data center.

While data centers have been around for decades, they’ve quickly expanded in recent years to support increasingly popular generative AI models.

There are different broad types of data centers. Some common ones include:

- Hyperscale data centers, which are warehouse-sized facilities that store advanced servers capable of handling massive processing workloads. They began growing in popularity with the advent of cloud computing services and cryptocurrency mining and are rapidly expanding amid the AI boom

- Enterprise data centers, which are owned and operated by businesses for their private data storage and computing needs

- Colocation data centers and service providers, which rent their facilities to individual businesses

Hyperscale facilities typically host at least 5,000 servers, but many contain far more and have footprints measuring tens of thousands to hundreds of thousands of square feet – with the largest hitting 1 million-plus. By comparison, the average data center usually has 2,000 to 5,000 servers. Smaller ones hold about 500 to 2,000.

How many data centers are in the U.S., and where are they?

There is no federal registration requirement for data centers, so their estimated number varies depending on the source. Some owners of data centers also obscure their locations for security reasons and/or competitive advantage.

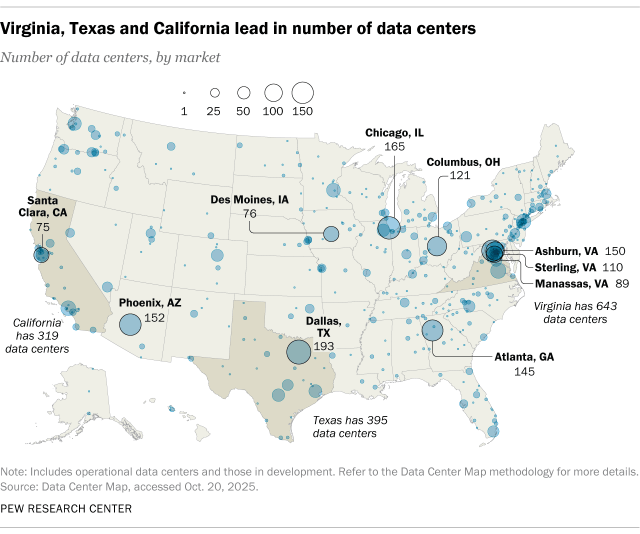

One of the oldest and most comprehensive industry databases is Data Center Map, which estimates that the U.S. has over 4,000 data centers, including operational sites and those under development. A third of U.S. data centers are in just three states: Virginia (643), Texas (395) and California (319).

Some of the nation’s key data center hubs are in northern Virginia, Dallas, Chicago and Phoenix. It’s likely they’ll retain their leading status: Half of the data centers currently being built in the U.S. are part of preexisting large clusters, according to an April report from the International Energy Agency (IEA).

Companies choose data center locations based on a variety of factors, including the availability of capable power utilities, properly zoned land, and high-quality network access. This makes previously developed hubs ideal for further investment.

Why are states competing for data centers?

Many states are offering financial incentives and expedited permitting to attract new data centers. They’ve done so in pursuit of the construction jobs, local tax revenue and future business opportunities that data centers can offer.

The federal government also has identified data center development as a national priority, committing land and funds to support their growth.

More broadly, supporters see data centers as worthwhile to spur local and national economic growth and ensure national security amid the global AI race. Some also see opportunities for AI to help solve environmental problems and improve the health care industry, among other benefits.

How much energy do data centers use?

Total annual U.S. electricity consumption hit a record high in 2024, and that ceiling could rise if data centers continue expanding at their current pace.

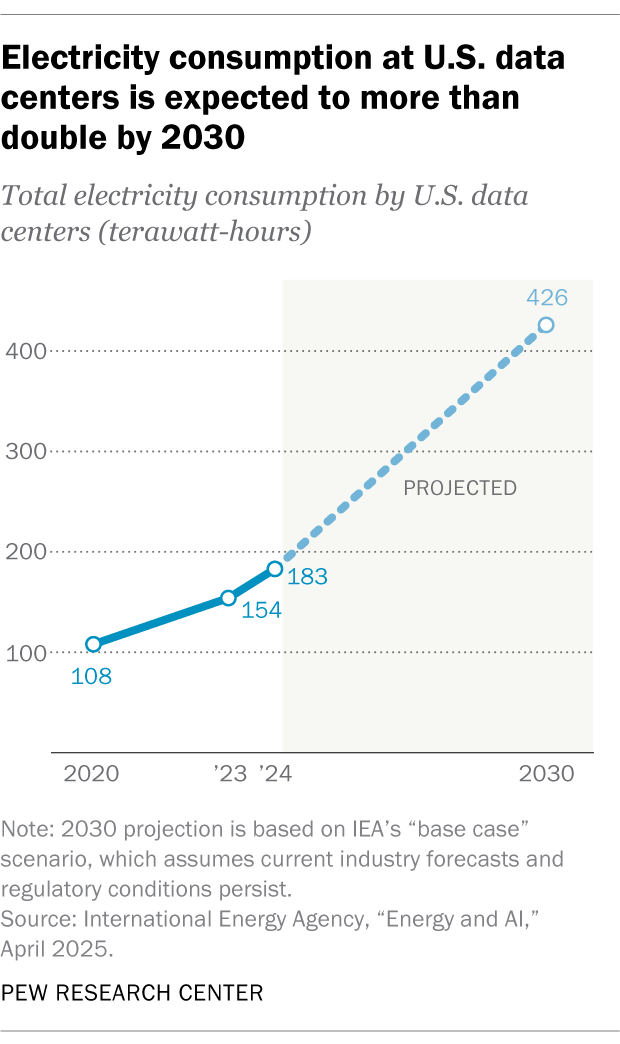

U.S. data centers consumed 183 terawatt-hours (TWh) of electricity in 2024, according to IEA estimates. That works out to more than 4% of the country’s total electricity consumption last year – and is roughly equivalent to the annual electricity demand of the entire nation of Pakistan. By 2030, this figure is projected to grow by 133% to 426 TWh.

Because data centers handle many types of workloads, it’s difficult to distinguish the exact share of their total electricity demand that comes from AI alone. But a typical AI-focused hyperscaler annually consumes as much electricity as 100,000 households. The larger ones currently under construction are expected to use 20 times as much, the IEA predicts.

Since data centers are often geographically concentrated, they can significantly strain the power grids. In 2023, data centers consumed about 26% of the total electricity supply in Virginia and significant shares of the supply in North Dakota (15%), Nebraska (12%), Iowa (11%) and Oregon (11%), according to the Electric Power Research Institute.

What is energy used for at data centers?

Most of the electricity used by data centers – about 60% on average, the IEA reports – powers the servers that process and store digital information. This is especially true at AI-optimized hyperscale data centers, whose advanced servers are equipped with powerful computer chips that can perform trillions of mathematical calculations per second. These chips consume much more energy than their traditional counterparts, requiring two to four times as many watts to run.

The next-largest component of energy use at data centers are the cooling systems that prevent servers from overheating. This share ranges from about 7% at efficient hyperscalers to over 30% at less efficient enterprise facilities.

These cooling systems often require a large amount of water, though some types use more than others. In 2023, the country’s data centers directly consumed about 17 billion gallons of water – with hyperscale and colocation facilities using the lion’s share (84%) – according to estimates in a 2024 Berkeley Lab report commissioned by the U.S. Department of Energy. Hyperscale data centers alone are expected to consume between 16 billion and 33 billion gallons of water annually by 2028. (These figures exclude water consumed indirectly, such as in the process of electricity generation or semiconductor manufacturing.)

What are the main energy sources for data centers?

As of 2024, natural gas supplied over 40% of electricity for U.S. data centers, according to the IEA. Renewables such as wind and solar supplied about 24% of electricity at data centers, while nuclear power supplied around 20% and coal around 15%.

Natural gas is projected to continue supplying the largest share of energy at data centers through 2030, but nuclear power could eventually play a larger role. Several tech companies have recently announced purchasing agreements with nuclear power startups. Plans are also in the works to revive two retired nuclear power plants – Three Mile Island in Pennsylvania and Duane Arnold in Iowa – to meet growing energy demand from data centers.

Related: Support for expanding nuclear power is up in both parties since 2020

Several states – including California, Illinois, Minnesota, New Jersey and Virginia – have weighed bills requiring or incentivizing data centers to draw some of their power from renewable energy sources and to report their electricity and water usage.

How could data centers affect Americans’ electricity bills?

Lawmakers and utility companies have faced pressure in some states to protect residents from blackouts and higher electricity bills as U.S. data centers expand their footprint.

Utilities often must make expensive upgrades to power grids so they can handle increased energy demands from new data centers. Smaller businesses and U.S. households often shoulder these costs unless ratepayer protections are put in place.

For example, in the PJM electricity market stretching from Illinois to North Carolina, data centers accounted for an estimated $9.3 billion price increase in the 2025-26 “capacity market” (i.e., the total amount of electricity that providers in the region commit to supplying). As a result, the average residential bill is expected to rise by $18 a month in western Maryland and $16 a month in Ohio.

Americans may see more widespread price hikes in coming years. One study from Carnegie Mellon University estimates that data centers and cryptocurrency mining could lead to an 8% increase in the average U.S. electricity bill by 2030, potentially exceeding 25% in the highest-demand markets of central and northern Virginia.

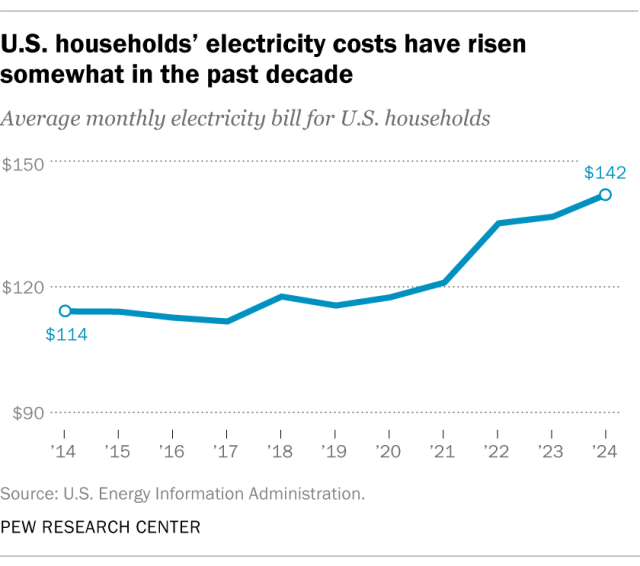

Nationally, electricity rates have already risen for consumers in recent years, in part because utility companies have been replacing aging equipment to safeguard against extreme weather events and cyberattacks.

For example, the typical U.S. household was billed $142 per month for electricity in 2024, according to data from the U.S. Energy Information Administration. That’s up 25% from $114 per month in 2014.

What do Americans think about AI’s potential impact on the environment?

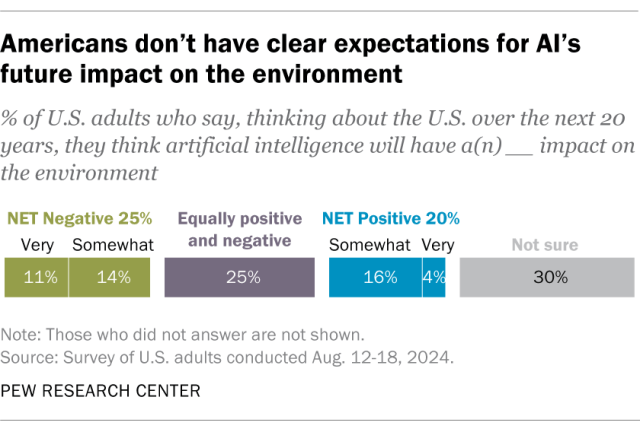

Pew Research Center has not surveyed Americans about the potential effects of data centers specifically. But when asked about the broader environmental impact that AI might have over the next 20 years, the public appears divided in its predictions, according to an August 2024 Center survey.

A quarter of U.S. adults think AI will have a negative impact on the environment, while an identical share say it will have an equally positive and negative impact. Another 20% foresee a positive impact, while 30% aren’t sure.

First Appeared on

Source link